Imagine a future where your deepest desires for financial abundance are not mere figments of your imagination, but tangible realities within your grasp. Envision a world where your ambitious dreams of prosperity, wealth, and affluence materialize effortlessly.

In this insightful exploration, we uncover the secret pathways to translating your longings for financial opulence into concrete achievements. By embracing strategic approaches, cultivating indispensable skills, and navigating the ever-evolving landscape of wealth creation, you can position yourself to manifest bountiful returns on your investments.

Delve into the enchanting world of possibilities as we delve into proven techniques, success stories, and expert guidance that will empower you to unlock the gates of prosperity. Allow yourself to be captivated by the captivating narratives of those who have dared to dream big and conquer a realm traditionally reserved for the select few.

Prepare to embark on a transformative journey, where you will learn to harness the unrivaled power of financial acumen, unleash your entrepreneurial spirit, and embark on a trajectory that has the potential to redefine your existence significantly. Make way for a future in which your aspirations align harmoniously with tangible achievements, as you uncloak the untapped potential that lies within you.

Manifesting Your Financial Aspirations: Transforming Ambitions into Accomplishments

Embarking on a journey towards achieving your financial goals requires more than just wishful thinking. It demands an unwavering dedication and strategic approach to turn your aspirations into tangible outcomes.

Creating a road map that will guide you towards financial success involves various essential steps. First and foremost, it is crucial to envision what you desire to accomplish. Visualize the life you aspire to lead, complete with all the elements of monetary freedom and security.

- Educate Yourself: To bridge the gap between imagination and reality, acquiring adequate knowledge is paramount. Invest time in learning about finance, investment strategies, and money management techniques. Continuous education will equip you with the necessary tools to make informed decisions and navigate the complexities of the financial world.

- Set Clear Goals: Clearly defined financial goals serve as the foundation of your journey towards prosperity. Break these goals down into smaller, attainable targets, ensuring that each milestone brings you closer to your overall ambition.

- Create a Solid Plan: Develop a comprehensive financial plan that outlines your strategies for earning, saving, and investing. This plan will serve as your roadmap, providing you with a structured approach to achieving your dreams.

- Take Calculated Risks: Building wealth often requires taking calculated risks. Evaluate opportunities and consider potential risks before making investment decisions. Embrace calculated risks that align with your financial objectives and tolerance for uncertainty.

- Stay Committed and Persistent: The path to financial success may have obstacles and setbacks along the way. However, with dedication and persistence, you can overcome these challenges and stay on track towards your goals.

Remember, transforming your financial dreams into reality is not an overnight process. It requires perseverance, discipline, and a proactive mindset. By following these steps and staying true to your ambitions, you can gradually turn your aspirations into accomplishments, paving the way for a financially fulfilling future.

Setting Clear Goals and Creating a Path to Success

In order to turn your aspirations into reality and achieve financial prosperity, it is essential to establish clear objectives and devise a well-defined plan to reach them. By setting goals and mapping out a path towards success, you can navigate through the complexities of life with purpose and determination.

Start by gaining a comprehensive understanding of your financial aspirations. Reflect on what truly matters to you and consider your long-term vision for financial stability. Whether it's attaining financial freedom, starting a business, or securing a comfortable retirement, identifying your goals will serve as your guiding light throughout your journey.

Once you have a clear picture of your financial objectives, break them down into smaller, more manageable goals. This step enables you to focus on specific areas and take actionable steps towards achievement. Each goal should be measurable, realistic, and time-bound to ensure accountability and progress.

- Prioritize your goals by ranking them in order of importance.

- Develop a timeline for achieving each goal, with milestones along the way to track your progress.

- Break down each goal into smaller tasks and create a to-do list to stay organized.

With your goals established and a roadmap in place, it is crucial to maintain a flexible mindset. Life often presents unexpected challenges and opportunities, requiring you to adapt and revise your plan accordingly. Regularly reassess your goals and adjust your roadmap as needed to stay aligned with your evolving circumstances and priorities.

Additionally, it is vital to stay motivated and accountable throughout your journey. Celebrate your achievements along the way, no matter how small, and seek support from friends, family, or a mentor who can provide encouragement and guidance. Consider tracking your progress visually, whether through a vision board or a financial planner, to keep your goals at the forefront of your mind.

Remember, achieving financial success is a result of consistent effort, dedication, and strategic planning. By setting clear goals, breaking them down into actionable steps, and staying flexible and motivated, you can pave your own path towards achieving your financial dreams.

Saving Strategies: Building a Solid Foundation for Achieving Financial Success

In this section, we will explore various effective approaches to save and grow your money, providing you with a strong basis for achieving your desired financial goals. By implementing these strategies, you can actively work towards securing your financial future.

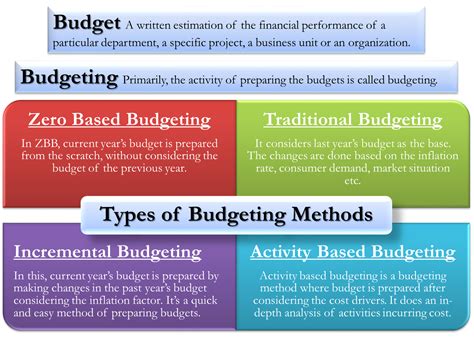

1. Budgeting Developing a comprehensive budget is essential in managing your finances effectively. By tracking your income and expenses, you can identify areas where you can cut back and allocate more funds towards savings. Consider using budgeting tools or apps to simplify the process. |

2. Frugality Embracing a frugal lifestyle can significantly contribute to your savings. Look for cost-efficient alternatives and practice wise spending habits. By distinguishing between needs and wants, you can prioritize your expenses and avoid unnecessary purchases, ultimately saving more money in the long run. |

3. Automating Savings Setting up automatic transfers from your checking account to a savings account can simplify the saving process. By automatically allocating a portion of your income towards savings, you reduce the temptation to spend and gradually build a substantial nest egg. |

4. Investing Wisely Exploring investment opportunities can potentially accelerate your financial growth. Consider diversifying your portfolio by investing in stocks, bonds, or real estate. However, make sure to conduct thorough research or seek advice from a financial advisor to mitigate risks and maximize returns. |

5. Minimizing Debt Paying off high-interest debts should be a priority to establish a solid foundation for financial success. Prioritize debt repayment by focusing on high-interest accounts first. Adopting a disciplined approach towards reducing your debt burden can free up financial resources for saving and investment. |

6. Emergency Fund Creating an emergency fund is crucial for maintaining financial stability. Aim to save at least three to six months' worth of living expenses in a separate account, ensuring that you have a safety net to rely on during unexpected situations like job loss or medical emergencies. |

By incorporating these saving strategies into your financial plan, you can establish a strong foundation for achieving long-term financial success. Consistent dedication and smart money management will enable you to make significant progress towards your goals, ensuring a brighter future for yourself and your loved ones.

Building a Lucrative Investment Portfolio: Maximizing Returns to Fulfill Your Aspirations

In this section, we will explore the art of wise investing and effective strategies to enhance your financial standing substantially. By strategically allocating your resources, you can make your money work harder for you and bring your long-cherished dreams closer to reality.

One fundamental aspect to consider when aiming to maximize returns is diversification. By spreading your investments across different asset classes, industries, and geographical regions, you can reduce the overall risk exposure and enhance the potential for consistent returns.

Additionally, continually staying informed and up-to-date about various investment opportunities is crucial. Conducting thorough research, analyzing market trends, and seeking professional advice are all essential steps to ensure you make informed investment decisions that align with your aspirations.

Furthermore, understanding the concept of risk and reward is essential to maximize returns. While it is tempting to chase short-term gains, it is important to have a long-term perspective and assess the potential risks associated with an investment opportunity. Balancing your portfolio with a mix of high-risk, high-reward investments along with more stable options is key to achieving sustainable growth.

Investing wisely also entails regularly reviewing and adjusting your investment strategy. By monitoring your portfolio's performance and making necessary adjustments based on changing market conditions, you can optimize returns and adapt to evolving circumstances.

Lastly, embracing patience and discipline is paramount. The world of investments can be volatile, with ups and downs being inevitable. However, staying committed to your long-term investment goals and avoiding impulsive decisions during turbulent times will help you weather the storm and reap the rewards in the end.

In conclusion, investing wisely is a powerful way to maximize returns and transform your aspirations into tangible achievements. By diversifying your portfolio, staying informed, managing risks, reviewing and adjusting your strategy, and maintaining patience and discipline, you can pave the path towards fulfilling your dreams and gaining financial independence.

Budgeting Techniques: Maximizing the Value of Each Dollar Towards Your Ultimate Goal

In this section, we will explore valuable budgeting techniques that can help you achieve your desired outcome without overspending or wasting money. The key is to focus on efficient allocation of funds, ensuring that every dollar contributes significantly towards accomplishing your financial aspirations.

One effective budgeting technique is creating a detailed spending plan. This involves identifying your income sources and categorizing your expenses to gain a clear understanding of where your money is being allocated. By analyzing your spending patterns, you can identify areas where you can potentially cut back or reallocate funds towards your dream.

Another strategy to make every dollar count is to adopt a mindset of conscious spending. This means becoming more mindful of your purchases and distinguishing between wants and needs. Prioritizing your financial goals, such as saving for your dream or paying off debts, can help you make wiser spending decisions and avoid impulsive purchases that do not align with your ultimate desires.

A vital aspect of effective budgeting is allocating funds towards saving and investments. By setting aside a portion of your income for future endeavors, you can create a safety net and accumulate the necessary funds to realize your dreams. Consider researching different saving and investment options that suit your financial goals, such as high-yield savings accounts or low-risk investment portfolios.

Furthermore, it is essential to regularly review and adjust your budget as circumstances change. Life is dynamic, and your financial situation may vary over time. Ensure that your budget aligns with your current goals and reevaluate your spending habits periodically to ensure maximum efficiency.

| Budgeting Techniques: | Making Every Dollar Count |

|---|---|

| 1. Create a detailed spending plan | Identify income sources and categorize expenses |

| 2. Practice conscious spending | Distinguish between wants and needs |

| 3. Allocate funds towards saving and investments | Create a safety net and accumulate funds for your dreams |

| 4. Regularly review and adjust your budget | Ensure alignment with current goals and optimize efficiency |

Unlocking Opportunities: Opening Doors to Financial Abundance

In this section, we will explore the various avenues available to individuals seeking to enhance their financial standing and manifest a prosperous future. By expanding our perspectives and actively seeking out opportunities, we can create a pathway towards financial abundance and fulfillment.

| Exploring Different Pathways | Embracing a Growth Mindset |

One key aspect of unlocking financial abundance is by exploring different pathways towards success. Instead of fixating on a single approach, it is essential to broaden our horizons and consider diverse options. This might involve investigating new industries or fields, taking advantage of emerging trends, or pursuing entrepreneurial ventures. By embracing a mindset of exploration and adaptability, we position ourselves to uncover hidden opportunities that can lead to wealth and prosperity. | A growth mindset is an indispensable asset when it comes to unlocking doors to financial abundance. By cultivating a belief in our ability to learn and improve, we open ourselves up to the possibility of continuous growth. This mindset encourages us to embrace challenges, persist in the face of setbacks, and view failure as an opportunity for learning and refinement. With a growth mindset, we can navigate the ever-changing landscape of success and seize opportunities that enable us to fulfill our financial dreams. |

| Fostering Connections and Collaboration | Cultivating Financial Literacy |

Another crucial aspect of unlocking doors to financial abundance is by fostering meaningful connections and collaborations. Networking with like-minded individuals, forming partnerships, and engaging in mutually beneficial relationships can significantly expand our opportunities. By sharing knowledge, resources, and support, we create a powerful ecosystem that fuels our collective growth and opens doors to new and exciting financial ventures. | Developing financial literacy is an essential skill that empowers us to make informed decisions and seize the right opportunities. It involves understanding core financial concepts, such as budgeting, investing, and managing debt. By continuously educating ourselves about the intricacies of personal finance, we equip ourselves with the knowledge and tools necessary to navigate the complex world of wealth creation. Cultivating financial literacy is a lifelong journey that can lead us towards a future filled with financial freedom and abundance. |

In conclusion, seeking opportunities and unlocking doors to financial abundance involve adopting a mindset of exploration, embracing growth, fostering connections, and cultivating financial literacy. By actively pursuing different pathways, nurturing our personal development, and engaging in collaborative endeavors, we can step closer to manifesting our financial dreams and creating a prosperous future.

FAQ

Is it possible to make my financial dreams come true by winning a huge cash prize?

Winning a huge cash prize can certainly help you achieve your financial dreams, but it is not the only way to do so. It's important to have a well-thought-out financial plan and work towards your goals consistently.

What are some practical steps I can take to increase my chances of winning a cash prize?

While winning a cash prize is largely a matter of luck, there are a few things you can do to increase your odds. Participating in contests with multiple prizes, entering regularly, and staying informed about ongoing competitions can improve your chances of winning.

What are some alternative strategies to achieve financial success instead of relying on winning a cash prize?

Rather than relying solely on winning a cash prize, it is advisable to focus on long-term financial planning. This can include setting realistic goals, saving and investing wisely, managing debt, and seeking additional sources of income. These strategies have a more consistent and reliable track record in achieving financial success.

If I do win a huge cash prize, what should I do to ensure it is used wisely to fulfill my financial dreams?

If you are fortunate enough to win a significant cash prize, it is crucial to approach it with caution. Seek advice from financial professionals to guide you in managing the windfall effectively. Prioritize paying off debts, creating a savings plan, and investing wisely to secure your future financial goals.

Are there any downsides or risks associated with winning a substantial cash prize?

While winning a substantial cash prize may seem like a dream come true, there can be downsides and risks. Some people may face challenges in managing sudden wealth, leading to financial mismanagement or even family disputes. It is important to remain grounded and seek professional advice to mitigate any potential risks and ensure your long-term financial well-being.

What are some practical steps I can take to make my financial dreams come true?

There are several practical steps you can take to make your financial dreams come true. First, start by setting specific financial goals and creating a detailed plan to achieve them. This plan should include budgeting, saving, and investing strategies. Additionally, it's important to educate yourself about personal finance and seek advice from financial experts. Stay committed to your goals, stay disciplined with your finances, and be patient as it may take time to achieve your dreams.

Is it possible to achieve financial dreams without winning a huge cash prize?

Absolutely! While winning a huge cash prize can certainly accelerate your financial progress, it is not the only way to achieve your financial dreams. The key to financial success lies in proper planning, budgeting, and saving. By setting realistic goals, creating a budget, and saving consistently, you can steadily progress towards your financial dreams. It's also important to invest wisely and take advantage of opportunities for growth. Winning a cash prize may be a stroke of luck, but with determination, discipline, and strategic financial decisions, you can achieve your dreams without relying solely on luck.