There is an indescribable yearning within each and every one of us to achieve financial freedom and live life on our own terms. We all seek that elusive secret to bolstering our bank accounts and breaking free from the shackles of financial constraints. It is not merely a mere fancy or fleeting desire; it is a relentless pursuit that fuels our ambitions and drives us to go above and beyond.

When it comes to cultivating a prosperous financial future, the path to increasing our income is adorned with countless possibilities and avenues of exploration. It is a multifaceted endeavor that requires a combination of strategic thinking, innovative approaches, and unwavering commitment. Through employing a range of bespoke techniques and nurturing a mindset attuned to financial growth, we can unlock the boundless potential within ourselves to pave the way for a more prosperous tomorrow.

However, it is important to note that the journey towards financial abundance goes far beyond the mere accumulation of material wealth. It is an adventure that demands resilience, adaptability, and a profound understanding of one's skills, talents, and passions. By embracing our unique abilities, harnessing the power of our creativity, and tapping into the vast opportunities presented by the modern world, we can forge a path that not only leads to increased wealth but also resonates with our true sense of purpose.

Strategies for Increasing Your Earnings and Attaining Financial Independence

In this section, we will explore various approaches you can employ to enhance your earnings and accomplish financial autonomy. We will delve into effective methods to boost your income streams, allowing you to secure a stable financial future.

Advancing your financial situation necessitates a proactive approach that entails diversifying your income sources. By seeking out alternative revenue streams and exploring new opportunities, you can generate additional funds beyond your primary salary or business earnings.

One approach to augment your income is through investing. Investing wisely in stocks, bonds, real estate, or other financial instruments can provide long-term growth and generate passive income. Understanding the risks and benefits of different investment options will empower you to make informed decisions and maximize your earning potential.

For those with specific talents, skills, or expertise, monetizing your abilities through freelancing or consulting can significantly supplement your earnings. This allows you to leverage your unique skills to provide services on a project-based or ongoing basis, catering to a broader client base and potentially commanding higher rates.

Another effective strategy involves acquiring new qualifications or enhancing existing ones. By continually upgrading your skills and staying abreast of industry trends, you can increase your value in the job market or command higher rates as a freelancer or consultant. Education and professional development are crucial investments that can yield substantial long-term returns.

Furthermore, leveraging the power of the internet and technology can pave the way for new income opportunities. Establishing an online presence or starting an e-commerce venture can provide access to a global customer base, opening doors for increased sales and profits. Additionally, leveraging social media platforms, affiliate marketing, or creating digital products can offer passive income streams that are not limited by traditional constraints.

Lastly, adopting a proactive savings and budgeting strategy is essential for long-term financial success. By managing your expenses, reducing debt, and consistently saving a portion of your income, you can gradually build wealth and attain financial freedom.

By employing a combination of these strategies, tailored to your unique circumstances and goals, you can chart a path towards increasing your earnings and ultimately achieving financial independence.

Diversify Your Income Streams for Stability and Growth

In today’s rapidly changing economic landscape, it is essential to explore various avenues to generate income in order to ensure stability and foster growth. By diversifying your income streams, you can reduce the reliance on a single source of income and increase your earning potential.

1. Embrace Multiple Income Sources: Instead of relying solely on a traditional 9-5 job, consider exploring alternative ways to generate income. This could include freelancing, starting a side business, investing in real estate or stock market, or leveraging your skills to offer consulting or coaching services. Having multiple streams of income provides a safety net and opens up opportunities for additional earning potential.

2. Leverage the Power of Passive Income: Passive income refers to earnings that require minimal effort to maintain. This can be achieved through investments in rental properties, dividend-yielding stocks, peer-to-peer lending, or creating digital products or online courses. By building passive income streams, you can generate income even when you are not actively working, creating a reliable and consistent source of earnings.

3. Embrace the Gig Economy: The rise of the gig economy has revolutionized the way people approach work. Embracing gig work, such as participating in ride-sharing services, freelance writing, or offering graphic design services, allows individuals to earn income on their own terms and create a flexible schedule. This not only diversifies income sources but also provides opportunities to explore new skills and industries.

4. Invest in Yourself: Continuously investing in your skills and knowledge is crucial in a rapidly evolving job market. Take advantage of educational opportunities, attend workshops or seminars, and pursue certifications or advanced degrees. By constantly improving yourself, you become a valuable asset and increase your earning potential across various income streams.

5. Build an Emergency Fund: No matter how diversified your income streams are, unexpected financial challenges can arise. It is important to build a robust emergency fund to provide a safety net during difficult times. Having a financial cushion allows you to weather unexpected storms, maintain financial stability, and continue focusing on building and diversifying your income streams.

In conclusion, diversifying your income streams is essential for financial stability and growth. By embracing multiple income sources, leveraging passive income opportunities, embracing the gig economy, investing in yourself, and building an emergency fund, you can create a solid foundation for increasing your earning potential and achieving financial success.

Invest in Yourself: Acquire New Skills and Knowledge

In today's competitive landscape, one of the key strategies to achieve financial success is by investing in yourself. By continuously acquiring new skills and knowledge, you can enhance your expertise and pave the way for increased earning potential. This section explores the significance of investing in yourself and provides actionable tips on how to effectively acquire new skills.

Embrace Lifelong Learning: Equipping yourself with a growth mindset is essential for personal and professional development. Embrace the idea that learning is a never-ending process, and constantly seek opportunities to expand your knowledge base.

Discover Your Passion: To maximize your earning potential, it is crucial to identify your true passions. By pursuing a field of interest, you can tap into your intrinsic motivation, leading to higher levels of satisfaction and potential monetary gains.

Seek Professional Development: Engaging in targeted professional development programs can provide you with specialized knowledge and skills relevant to your industry. Consider attending conferences, workshops, or online courses that align with your career goals.

Network and Collaborate: Building a strong professional network is essential for success in today's interconnected world. Surround yourself with like-minded individuals who can offer guidance, support, and opportunities for skill enhancement and career growth.

Stay Updated with Industry Trends: To remain relevant in your field, it is crucial to stay updated with the latest industry trends and advancements. Subscribe to relevant newsletters, follow industry influencers on social media, and read authoritative publications to ensure continuous professional growth.

Develop Soft Skills: While technical skills are important, possessing strong interpersonal and communication skills can set you apart from the competition. Invest time and effort in improving your ability to collaborate, lead, and effectively communicate with others.

Take Calculated Risks: Stepping out of your comfort zone and taking calculated risks can lead to valuable experiences and unexpected opportunities. Be open to new challenges and be willing to adapt and learn from your failures along the way.

By investing in yourself and actively seeking new skills and knowledge, you can enhance your expertise, attract higher-paying opportunities, and ultimately achieve your financial goals.

Leverage the Power of the Gig Economy

The Gig Economy: A Gateway to Unlocking Financial Potential

Discover how embracing the gig economy can be a game-changer in your quest for additional income. By tapping into this flexible and ever-expanding job market, you can engage in a variety of short-term, project-based opportunities that offer considerable financial rewards. Whether you have a specific set of skills or simply possess the dedication and willingness to learn, the gig economy presents countless avenues to bolster your financial prospects.

Embrace Your Side Hustle: Navigating the New World of Freelancing

Mastering the art of freelancing allows you to harness your expertise and monetize it on your own terms. Whether you possess a passion for creative writing, graphic design, programming, or a myriad of other talents, freelancing platforms connect you directly with clients seeking your precise skills. By establishing a strong online presence, building your portfolio, and effectively marketing your services, you can create a sustainable and lucrative side hustle that complements your primary source of income.

Unleash the Entrepreneur Within: Capitalize on the Gig Economy as an Independent Business Owner

If you possess an entrepreneurial spirit and aspire to be your own boss, the gig economy is the perfect playground for your ambitions. By launching your own independent venture, you can leverage the power of the gig economy to expand your customer base and ultimately increase your profits. Whether you choose to offer specialized services, sell unique products, or provide niche consultations, tapping into the gig economy offers unparalleled opportunities to grow your business and maximize your earning potential.

Work Whenever, Wherever: Embracing the Freedom of Remote Work

The gig economy provides the freedom to work remotely, granting you the flexibility to earn money on your own terms. Whether you prefer to work from the comfort of your home, a coworking space, or even while traveling the world, the gig economy allows you to break free from traditional constraints. Explore remote job opportunities that align with your skills and interests, liberate yourself from the 9-5 grind, and enjoy the autonomy and satisfaction that come with being a self-employed professional.

Collaborate and Flourish: Thrive in the Gig Economy by Building Networks and Partnerships

Networking and forming partnerships are essential strategies to excel in the gig economy. By connecting with like-minded individuals, industry experts, and potential clients, you can tap into a wealth of opportunities for collaboration, growth, and increased income. Engaging in professional communities, attending industry events, and harnessing the power of social media can all contribute to expanding your network and building meaningful relationships that propel you towards financial success.

Maximize Your Earnings through Salary Negotiation

Enhance your ability to boost your earnings by mastering the art of salary negotiation. Negotiating a higher salary can have a significant impact on your overall income and financial stability.

- Understand your worth: Recognize your skills, qualifications, and the value you bring to the table.

- Research market rates: Explore salary benchmarks and industry standards to determine a realistic salary range for your position and experience.

- Showcase your achievements: Highlight your accomplishments, projects, and successful outcomes to demonstrate the tangible results you have delivered.

- Develop persuasive communication skills: Master the art of articulating your value proposition, presenting your case convincingly, and maintaining a confident and professional demeanor.

- Build a strong case: Gather facts, figures, and relevant data to support your request for a higher salary. Outline the positive impact you will bring to the organization.

- Consider additional benefits: Aside from salary, explore other compensation elements such as bonuses, flexible work arrangements, professional development opportunities, and healthcare benefits.

- Practice negotiation techniques: Role-play negotiation scenarios to refine your negotiation skills and strategies. Anticipate potential objections and be prepared to overcome them persuasively.

- Be open to compromise: While aiming for the best possible outcome, be willing to consider alternative proposals and find mutually beneficial solutions.

- Stay confident and persistent: Maintain a positive mindset and be prepared to negotiate respectfully and persistently. Don't be afraid to ask for what you deserve.

- Follow up: After the negotiation process, express gratitude for the opportunity to discuss your salary and, if successful, ensure the agreed-upon terms are reflected accurately in your employment contract.

By adopting effective salary negotiation techniques, you can significantly maximize your earnings and pave the way for long-term financial success and growth.

Discover the Potential of Starting a Side Business: Transform Your Passion into Profit

Unveiling the untapped possibilities of venturing into a side business can be an extraordinary opportunity to monetize your personal interests and turn them into substantial financial gains. By tapping into your passions and leveraging them to create a thriving entrepreneurial endeavor, you can open doors to new avenues of income and achieve the financial success you desire.

Turning your passion into profit is not only a means of augmenting your financial resources but also a way to break free from the traditional 9-to-5 work routine. By proactively starting a side business, you can unleash your creative potential, explore your talents, and maximize your earning potential.

Embarking on a side business allows you to pursue your passion projects while generating supplemental income. Whether it's crafting handmade products, providing consulting services, or offering online courses, the possibilities are endless. Through effective marketing strategies, networking, and developing a loyal customer base, you can transform your niche expertise into a lucrative source of revenue.

With the advent of digital platforms and the exponential growth of e-commerce, starting a side business has never been more accessible. Online marketplaces, social media platforms, and e-commerce websites offer a low-cost entry point into the world of entrepreneurship. By embracing these digital platforms, you can reach a global audience, build a strong online presence, and attract customers from various corners of the globe.

In addition to the financial benefits, starting a side business allows you to prioritize your personal and professional growth. By pursuing your passion and honing your skills, you can cultivate a sense of fulfillment and satisfaction that extends beyond monetary gains. Building a side business also instills valuable qualities such as resilience, adaptability, and perseverance, which can benefit your overall professional development.

Now is the time to seize the opportunity and transform your dreams into a thriving side business. By harnessing your passion and leveraging the vast array of resources available, you can embark on a fulfilling entrepreneurial journey and create a sustainable income stream, ultimately paving the way for a brighter financial future.

Create Passive Income: Generate Cash While You Sleep

In today's fast-paced world, many individuals dream of achieving financial freedom and making money even when they're not actively working. Creating a passive income stream is an effective strategy to turn this dream into reality. By generating income while you sleep, you can enjoy the freedom to pursue other passions and create a more secure financial future.

One approach to creating passive income is by investing in rental properties. Owning and renting out properties can provide a steady stream of income through monthly rent payments. Real estate investing offers the potential for long-term growth and significant returns. By carefully selecting desirable properties and managing them efficiently, you can establish a reliable source of passive income.

A popular method to generate passive income is by investing in dividend stocks. Dividends are regular cash payments distributed by companies to their shareholders. By investing in established companies that pay consistent dividends, you can earn a passive income stream based on your ownership stake. This approach allows you to benefit from the growth potential of the stock market while receiving regular payouts.

Creating and selling digital products is another lucrative way to generate passive income. Whether it's an e-book, an online course, or a software application, digital products can be created once and sold repeatedly. By leveraging your expertise and knowledge, you can provide value to customers while generating continuous income without the need for ongoing physical production or distribution.

Building a successful blog or website that attracts a large audience can also provide opportunities for passive income. By monetizing your platform through advertising, sponsored content, or affiliate marketing, you can generate income from the traffic and engagement your site receives. With consistent effort and quality content, your blog or website can become a passive income generator.

Investing in peer-to-peer lending platforms is another method to consider. These platforms connect investors with borrowers, providing an opportunity to earn interest on loans. By diversifying your investments across different borrowers and carefully assessing the risk, you can create a diversified portfolio that generates passive income from interest payments.

- Invest in rental properties

- Invest in dividend stocks

- Create and sell digital products

- Build a successful blog or website

- Invest in peer-to-peer lending platforms

By exploring these various strategies, you can begin to create passive income streams that generate money while you sleep. Remember, building passive income takes time, effort, and careful planning, but the rewards can be significant. Start taking steps towards financial independence and enjoy the benefits of earning income even when you're not actively working.

Network and Collaborate: Harnessing Professional Relationships

In the pursuit of increasing your income and achieving financial growth, it is crucial to cultivate and nurture your professional relationships. Building a strong network and collaborating with others within your industry can open doors to new opportunities, valuable insights, and potential financial gains.

1. Leverage your connections: Start by taking advantage of your existing network and making meaningful connections with colleagues, mentors, and other professionals in your field. Maintain regular communication and actively engage with them to establish a mutually beneficial relationship.

- Attend industry events, conferences, and seminars to meet like-minded individuals and expand your network.

- Utilize online professional platforms such as LinkedIn to connect with professionals within your industry.

- Join professional organizations and associations related to your field to gain access to a wider network of industry experts.

2. Collaborate for success: Collaborating with others can lead to innovative ideas, shared resources, and increased visibility. Consider the following collaboration opportunities:

- Partner with complementary businesses or professionals to provide joint services or cross-promote each other's offerings.

- Join forces with colleagues to work on larger projects or bid for contracts together.

- Form or join mastermind groups where like-minded individuals gather to share ideas, knowledge, and insights.

3. Foster strong relationships: Building genuine relationships based on trust and mutual support can be key to unlocking new income streams. Here are some strategies to foster strong professional relationships:

- Be proactive in offering help and support to your network, whether it's sharing resources or providing valuable feedback.

- Show genuine interest in others' professional endeavors and actively engage in conversations to establish rapport.

- Attend industry-related social events or organize networking gatherings to deepen relationships outside of the professional realm.

Remember, building and maintaining professional relationships requires time, effort, and a genuine interest in the success of others. By effectively harnessing your network and collaborating with others, you can create opportunities that may contribute to the growth of your income and overall financial success.

Embrace Financial Education: Master the Art of Money Management

In today's dynamic economic landscape, cultivating a solid understanding of financial education and mastering the art of money management is paramount for individuals seeking to achieve their financial goals. Acquiring the necessary knowledge and skills to effectively manage personal finances empowers individuals to make informed decisions, ensure financial stability, and harness the potential for long-term wealth creation. By embracing financial education, individuals can navigate the complexities of financial markets, plan for the future, and optimize their financial resources.

Empower Yourself with Essential Financial Knowledge

Developing a strong foundation in financial literacy equips individuals with the tools required to make educated financial decisions. When individuals possess an understanding of key financial concepts such as budgeting, investing, saving, and debt management, they become better positioned to achieve their financial objectives. By pursuing avenues for financial education, individuals can learn about various financial instruments, assess risk tolerance, construct diverse investment portfolios, and gain the confidence necessary to take control of their financial future.

Cultivate Effective Money Management Skills

Mastering the art of money management involves adopting strategies and techniques that optimize financial resources. It requires individuals to develop a habit of budgeting, tracking expenses, and setting realistic financial goals. Moreover, effective money management entails understanding the nuances of credit, debt repayment, and interest rates, allowing individuals to leverage credit responsibly while avoiding unnecessary financial burdens. By cultivating strong money management skills, individuals can adopt a proactive approach to their finances, ensuring a solid foundation for financial growth and stability.

Embrace Lifelong Learning and Adaptation

Financial education is not a one-time endeavor; it is a lifelong journey that requires constant learning and adaptation to evolving economic landscapes. Individuals should proactively seek opportunities to enhance their financial knowledge by staying updated with current trends, exploring educational resources, and engaging with financial professionals. By embracing a growth mindset and committing to continuous learning, individuals can navigate changes in the financial world, stay current with emerging technologies, and develop strategies to capitalize on new opportunities.

By embracing financial education and mastering the art of money management, individuals can pave the way for a more secure financial future, achieve their dreams, and attain greater financial independence.

Capitalizing on the Digital World: Exploring Opportunities for Online Business

The digital age has opened up a world of possibilities for individuals looking to expand their income streams. With the emergence of various online platforms and tools, there are numerous opportunities to tap into the vast potential of the internet to boost your financial prospects. This section will delve into the realm of online business and explore the different avenues available for you to monetize your skills, knowledge, and resources.

1. E-commerce:

In today's digital landscape, e-commerce has become an integral part of the global economy. Setting up an online store allows you to reach customers globally, breaking the limitations of physical retail locations. Whether you choose to sell physical products or digital goods, e-commerce platforms provide a scalable and cost-effective way to start and grow your online business.

2. Freelancing:

The rise of freelancing platforms has revolutionized the way people work and earn money. Through freelancing, you can leverage your expertise in various fields such as graphic design, writing, programming, marketing, and more. These platforms connect freelancers with clients seeking their specific skills, enabling you to work remotely and earn income on a flexible schedule.

3. Online Consulting and Coaching:

If you possess specialized knowledge or expertise in a particular field, offering online consulting or coaching services can be a lucrative venture. With video conferencing tools and virtual collaboration platforms, you can provide personalized advice, guidance, and training to individuals or businesses seeking your expertise, regardless of their geographical location.

4. Content Creation:

The demand for content creation has skyrocketed, with businesses and individuals constantly seeking compelling and informative material. Whether it's writing blog posts, creating videos, designing graphics, or producing podcasts, the digital world offers a variety of platforms and monetization models to turn your creativity into a profitable endeavor.

5. Online Marketplaces and Auctions:

Participating in online marketplaces and auctions can provide opportunities to earn money by selling new or used goods, unique collectibles, or handmade crafts. These platforms offer a wide customer base and convenient tools for listing and managing your products, allowing you to capitalize on niche markets and generate additional income.

- Explore the potential of online business models such as dropshipping and affiliate marketing.

- Consider leveraging social media platforms to promote and sell your products or services.

- Stay up-to-date with the latest digital trends to identify emerging opportunities.

- Build a strong online presence through effective branding and marketing strategies.

- Continuously learn and adapt to the evolving digital landscape to stay competitive.

By exploring these online business opportunities and leveraging the power of the digital world, you can pave your way to financial growth and achieve your income goals.

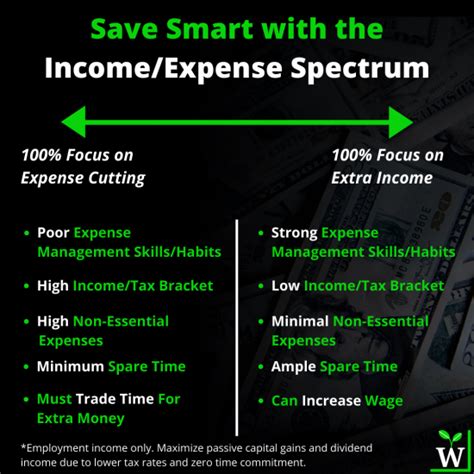

Manage Your Expenses: Boost Your Savings for Increased Earnings

In order to achieve financial growth and a higher income, it is important to ensure that your expenses are well-managed. By keeping your spending habits in check and increasing your savings, you can create a solid foundation for earning more money and achieving your financial goals.

One effective strategy is to carefully track your expenses and identify areas where you can cut back or make more cost-effective choices. By reducing unnecessary expenditures and making smarter purchasing decisions, you can free up more money to save and invest in income-generating opportunities.

It is also essential to prioritize your expenses and differentiate between needs and wants. This means consciously evaluating your spending and focusing on essential items and services while minimizing discretionary purchases. By doing so, you can allocate more of your income towards savings and investments, ultimately increasing your earning potential.

In addition to managing your everyday expenses, it is crucial to always be prepared for unexpected financial challenges. Building an emergency fund can provide a safety net during times of unforeseen expenses and can prevent you from going into debt. This will give you peace of mind and allow you to concentrate on finding ways to increase your income without the added worry of financial instability.

Another aspect of keeping your expenses in check is acquiring knowledge and skills that allow you to save money in various areas of your life. This can include learning DIY techniques for home repairs, finding affordable alternatives for entertainment, or becoming more energy-efficient to lower utility bills. By being resourceful and proactive in finding cost-saving measures, you can further maximize your savings and create more opportunities for earning more in the long run.

Ultimately, by managing your expenses effectively and optimizing your savings, you can establish a strong financial foundation that will support your dreams of increased income. Through careful planning, prioritization, and a proactive approach to cost-saving, you can create more opportunities for financial growth and maximize your earning potential.

FAQ

How can I increase my income?

There are several strategies you can adopt to boost your income. One way is to ask for a raise or negotiate better compensation at work. Another option is to take on additional freelance or part-time work. You could also consider investing your money in stocks, real estate, or other ventures. Additionally, acquiring new skills or education in high-demand fields can lead to better-paying job opportunities.

Is it possible to make extra money without working more hours?

Absolutely! Increasing your income doesn't necessarily mean working more hours. One way to make extra money without additional work is by creating passive income streams. This can include investing in stocks, bonds, or real estate properties that generate consistent returns. Another option is to monetize a hobby or passion by starting a small business or selling products or services online. Additionally, you can consider renting out a spare room or property for additional income.

What skills should I develop to increase my income?

Developing certain skills can greatly contribute to increasing your income potential. In today's job market, skills related to technology, data analysis, programming, and digital marketing are in high demand. Learning these skills through online courses or attending workshops can make you more attractive to employers and potentially command higher salaries. Additionally, soft skills such as effective communication, leadership, and problem-solving are valuable attributes that can help you advance in your career and earn more.

How can I effectively negotiate a higher salary?

Negotiating a higher salary can be intimidating, but with the right approach, it is possible. Firstly, research the average salary range for your position and industry to have a benchmark for your negotiation. Then, highlight your accomplishments and contributions to the company, demonstrating your value. It's important to be confident and professional during the negotiation process. Consider practicing with a friend or mentor beforehand to gain more confidence. Lastly, be willing to compromise and explore other forms of compensation, such as bonuses or additional benefits, if a significant salary increase is not immediately feasible.