Every parent yearns for their child's bright and prosperous tomorrow. We all want our sons to thrive, to make their mark in the world, and to have a secure and fulfilling future – a future that's characterized by limitless possibilities and opportunities. However, the journey to ensuring a successful path for our boys is not always straightforward, and it requires careful planning, nurturing, and guidance.

This article aims to provide you with valuable insights and practical strategies to empower you as a parent in securing your son's desired outcomes. Through a comprehensive exploration of various approaches, we will delve into proven methods to help shape your son's future, harness his potential, and capitalize on his unique strengths.

Understanding your son's individuality is an essential starting point. Each child is unique, with distinct abilities, interests, and aspirations. Recognizing and embracing your son's individuality is key to unlocking his full potential. By identifying his strengths and passions, you can cultivate an environment that fosters growth and development, allowing him to flourish in his own way.

Building a strong foundation is another crucial aspect in ensuring your son's future success. This involves imparting essential life skills, such as discipline, resilience, and problem-solving abilities. By instilling these core values, you are equipping him with the tools necessary to overcome challenges and make sound decisions, all of which are vital for a prosperous future.

Building a Solid Financial Base

Setting a strong financial foundation is crucial for securing a prosperous future for your child. Establishing a firm financial base involves laying down the necessary groundwork to ensure sound financial practices, investing wisely, and cultivating good financial habits.

Understanding Financial Literacy: Enhancing your knowledge and understanding of financial concepts is the first step towards building a strong financial foundation. It is important to familiarize yourself with key financial terms and principles to make informed decisions and navigate the complex world of finance.

Planning for the Long Term: Creating a comprehensive financial plan is essential for your child's future financial security. This involves determining long-term goals, such as saving for education, retirement, or major life events, and developing a strategic roadmap to achieve them.

Practicing Saving and Budgeting: Instilling the habit of saving and budgeting from an early age equips your child with valuable skills for managing money responsibly. Encouraging regular savings and teaching them to budget effectively will help them develop a sense of financial discipline and responsibility.

Investing Wisely: Investing wisely is a key component of building a strong financial base. Understanding different investment options, diversifying your portfolio, and seeking professional advice, when needed, can maximize the growth potential of your investments and increase your child's financial security.

Teaching Financial Responsibility: Cultivating financial responsibility is crucial for your child's future success. Teaching them about the importance of financial independence, the consequences of debt, and the value of delayed gratification will empower them to make wise financial decisions and avoid unnecessary financial hardships.

Building an Emergency Fund: A well-established financial foundation involves preparing for unexpected expenses by setting up an emergency fund. Having this safety net can provide peace of mind during difficult times and prevent financial setbacks from derailing your child's future goals.

Seeking Professional Guidance: Consider reaching out to financial advisors or professionals who can provide expert guidance on building a solid financial foundation for your child's future. They can help you analyze your financial situation, set realistic goals, and develop a customized plan to ensure long-term financial stability.

By focusing on these key aspects, you can successfully build a strong financial foundation that sets your child on the path to a secure and prosperous future.

Investing in Education: Unlocking the Path to Long-Term Success

In this section, we explore the significance of investing in education as a strategic way to ensure a flourishing future for your child. Emphasizing the paramount role played by education in shaping an individual's long-term success, we delve into the various benefits it brings and the ways in which it can open doors of opportunities.

Education serves as a transformative force, empowering individuals with knowledge, skills, and critical thinking abilities, thereby enabling them to navigate the complexities of the ever-evolving world. By investing in education, parents make a conscious effort to equip their children with the necessary tools and competencies to excel academically, personally, and professionally.

A key advantage of investing in education is the potential for long-term returns. Just as financial investments yield compound interest over time, education acts as an intellectual investment that accumulates value as the years progress. The cultivation of a strong educational foundation early on lays the groundwork for a lifelong journey of learning and growth.

| Benefits of Investing in Education |

|---|

| 1. Expanded Opportunities |

| 2. Enhanced Employability |

| 3. Intellectual Stimulation |

| 4. Personal Development |

| 5. Social Mobility |

Investing in education goes beyond the acquisition of knowledge; it empowers individuals to become active participants in society, driving positive change and contributing to the betterment of their communities. Through education, individuals gain the capacity to critically analyze, innovate, and solve problems, positioning them for success in an increasingly interconnected world.

In conclusion, investing in education is not only a means to secure a prosperous future for your child but also an investment in the development of a well-rounded, empowered individual. By prioritizing education, parents lay a strong foundation for their children, enabling them to navigate the challenges and seize the opportunities that lie ahead, ultimately unlocking the path to long-term success.

Planning for Retirement: Ensuring a Comfortable Life

As we journey through life, it is essential to proactively plan for our retirement to guarantee a comfortable and fulfilling future. The choices we make today lay the foundation for our financial stability and well-being in the years to come.

1. Prioritize Savings:

- Make saving a top priority as early as possible, ensuring a steady accumulation of funds over time.

- Consider various investment options to diversify your portfolio and maximize returns.

- Explore retirement savings plans such as 401(k)s or individual retirement accounts (IRAs) that offer tax advantages.

2. Set Clear Financial Goals:

- Define your retirement lifestyle and estimate the expenses you will incur to maintain it.

- Calculate how much you need to save to achieve your desired financial goals.

- Monitor your progress regularly and make adjustments as necessary.

3. Reduce Debt and Manage Expenses:

- Strategize and prioritize debt repayment to alleviate financial burdens.

- Create a budget to track and control your monthly expenses.

- Identify areas where you can cut unnecessary costs to save more for your retirement.

4. Consider Retirement Income Sources:

- Explore various retirement income options, such as pensions, social security benefits, and annuities.

- Investigate potential opportunities for part-time work or freelancing during retirement to supplement your income.

- Take advantage of employer-sponsored retirement plans and any matching contributions provided.

5. Seek Professional Financial Advice:

- Consult with a certified financial planner who can provide personalized guidance tailored to your specific needs.

- Ensure you fully understand your investment options and potential risks before making any decisions.

- Regularly review and reassess your retirement plan with the help of a financial professional.

By following these practical steps, you will be well on your way to building a solid foundation for a comfortable and secure retirement. Remember, proper planning today will lead to a tomorrow filled with financial peace of mind and the freedom to enjoy the fruits of your labor.

Understanding the Significance of Insurance Coverage

Exploring the relevance and value of having insurance coverage can enable individuals to safeguard their loved ones and their financial stability in times of uncertainty.

Protection Insurance coverage acts as a shield that safeguards individuals and their families from potential risks and unexpected events. It provides financial support in challenging times, ensuring the well-being and security of loved ones. | Security With insurance coverage in place, individuals can experience peace of mind knowing that their loved ones will be supported financially in the case of an unfortunate event. This security allows individuals to focus on their present without worrying about an uncertain future. |

Preparation Insurance coverage serves as a tool for preparedness, helping individuals plan ahead for unexpected circumstances. By understanding their coverage options and choosing the right policies, individuals can mitigate the impact of unforeseen events and secure their financial stability for the long term. | Assistance In times of crisis or tragedy, insurance coverage provides crucial financial assistance. It not only covers medical expenses but also extends support for rehabilitation, property damage, liability, and other related costs. This assistance can offer a lifeline during challenging times. |

Peace of Mind Having insurance coverage brings a sense of tranquility, knowing that financial protection is in place. This peace of mind allows individuals to focus on achieving their goals and dreams, without constantly worrying about the potential risks and uncertainties that life may bring. | Future Planning Insurance coverage plays a vital role in securing one's future plans and aspirations. Adequate coverage ensures financial stability, allowing individuals to plan for their retirement, their children's education, and other long-term goals with confidence. |

Teaching Financial Literacy: Nurturing Responsible Money Management

Amidst the ever-changing landscape of the modern world, ensuring our children are equipped with the knowledge and skills to make sound financial decisions becomes an essential aspect of their future success. By instilling financial literacy, we empower our sons and daughters to navigate the complexities of personal finance, empowering them to make responsible choices and secure their economic well-being. In this section, we will explore practical strategies to help teach your children the foundations of money management and develop their financial independence.

Nurturing a strong foundation: It is crucial to start teaching financial literacy at a young age. By introducing basic concepts such as budgeting, saving, and distinguishing between wants and needs, we lay the groundwork for responsible money management. Engaging children in age-appropriate discussions about money and involving them in financial decision-making processes allows them to develop crucial skills that will serve them well throughout their lives.

Cultivating smart spending habits: Teaching our children to be conscious consumers is a vital component of financial literacy. Encouraging them to research and compare prices, identify value for money, and consider long-term consequences before making purchases contributes to developing responsible spending habits. By teaching them to differentiate between essential and discretionary expenses, we empower them to make informed choices that align with their financial goals.

Building savings and investments: Instilling the habit of saving and investing from an early age sets the stage for long-term financial stability. Teaching children the importance of setting financial goals and working towards them fosters discipline and patience. Moreover, introducing the concept of compound interest can illustrate the potential rewards of saving money, encouraging them to cultivate sustainable financial practices.

Understanding debt and credit: Equipping children with the knowledge of debt and credit empowers them to make informed decisions and avoid potential pitfalls. Teaching concepts such as interest rates, credit scores, and the responsible use of credit cards helps them understand the implications of borrowing and the importance of maintaining a healthy financial profile. By instilling responsible borrowing habits, we equip our children to make informed decisions when it comes to managing debt and using credit wisely.

Practicing philanthropy and giving back: Financial literacy goes beyond personal gain; it also encompasses the importance of giving back to society. Encouraging children to engage in philanthropic activities and make donations fosters a sense of social responsibility. By teaching them about charity and the power of helping others, we mold conscientious individuals who understand the value of using their financial resources for the greater good.

By taking an active role in teaching our children about financial literacy, we empower them to become financially responsible individuals who are better prepared to navigate the complex financial landscape of the future. By equipping them with the necessary tools and knowledge, we lay the foundation for their lifelong financial success.

Exploring Different Long-Term Investment Options

When planning for the future, it is essential to consider various long-term investment options that can help you achieve your financial goals without relying solely on traditional savings accounts. By exploring different investment avenues, you can discover opportunities to grow your wealth and secure your family's financial security.

1. Stocks and Bonds:

- Equities: Investing in stocks of well-established companies can provide potential growth and dividend income over the long term.

- Bonds: Government or corporate bonds offer fixed interest payments and can be a reliable source of steady income.

2. Real Estate:

- Residential Properties: Investing in residential real estate can generate rental income and potential capital appreciation.

- Commercial Properties: Owning commercial properties can provide stable income through lease agreements with businesses.

3. Mutual Funds and ETFs:

- Mutual Funds: Diversify your investment portfolio by pooling money with other investors to invest in a variety of assets managed by professionals.

- Exchange-Traded Funds (ETFs): Similar to mutual funds, ETFs offer diversification but can be traded throughout the day on stock exchanges.

4. Retirement Accounts:

- 401(k)s: Employer-sponsored retirement accounts allow you to contribute pre-tax income, potentially reducing your taxable income while saving for retirement.

- Individual Retirement Accounts (IRAs): Traditional and Roth IRAs offer tax advantages that can help you save for retirement.

5. Education Savings Accounts:

Investing in education savings accounts, such as 529 plans, can help you save for your child's future education expenses while taking advantage of potential tax benefits.

6. Alternative Investments:

- Commodities: Invest in physical goods like gold or oil to diversify your investment portfolio.

- Hedge Funds: Consider investing in hedge funds that employ various strategies to potentially generate above-average returns.

In conclusion, understanding and exploring different long-term investment options can open up a world of opportunities for securing your family's financial future. It's crucial to evaluate the risk-reward profile of each investment avenue and consider your financial goals, time horizon, and risk tolerance when making investment decisions. Consulting with a financial advisor can provide valuable insights tailored to your specific needs and circumstances.

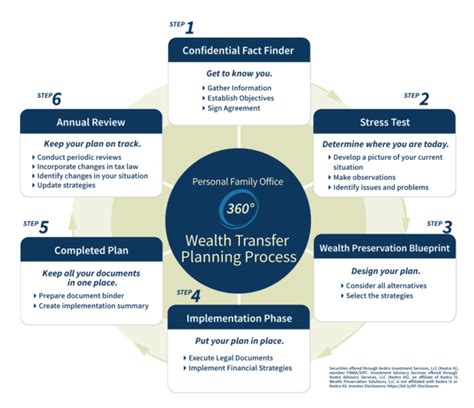

Efficient Wealth Transfer: Planning for the Future

Planning for the smooth transfer of wealth is a crucial aspect of ensuring the long-term financial security of your family. By developing a well-thought-out succession plan, you can efficiently pass on your accumulated assets, ensuring that your loved ones are well provided for.

Creating a Strategy: One key element of succession planning is developing a comprehensive strategy that takes into account various factors such as tax implications, legal considerations, and individual circumstances. By carefully analyzing your financial situation and seeking professional advice, you can create a solid roadmap for the transfer of your wealth.

Identifying Beneficiaries and Roles: It is essential to clearly define and identify the beneficiaries of your wealth and assign specific roles to family members or trusted individuals who will oversee its management. This will help ensure a smooth transition and avoid potential conflicts or misunderstandings in the future.

Estate Planning and Trusts: Utilizing estate planning tools, such as wills and trusts, can help streamline the transfer process and minimize tax liabilities. Creating a trust can provide additional benefits, such as protecting assets from creditors and ensuring controlled distributions to beneficiaries.

Regular Reviews: As financial circumstances and goals may change over time, it is important to regularly review and update your succession plan. This ensures that it remains aligned with your current financial situation and reflects any changes in laws or regulations that may affect the transfer of wealth.

Communication and Education: Open and transparent communication with your family members about your succession plan is crucial. By sharing your intentions and educating them about your financial affairs, you can help them prepare for their future roles and responsibilities, fostering a sense of unity and understanding within the family.

Professional Guidance: Seek the assistance of experienced professionals, such as financial advisors, estate planners, and tax consultants, who can provide invaluable guidance and expertise in navigating the complexities of succession planning. Their knowledge and support will ensure that your wealth is transferred efficiently and in accordance with your wishes.

In conclusion, efficient wealth transfer through succession planning is a significant step towards securing the long-term financial well-being of your family. By developing a strategic plan, identifying beneficiaries, utilizing estate planning tools, regularly reviewing your plan, fostering open communication, and seeking professional guidance, you can successfully pass on your wealth and provide for future generations.

Balancing Risks and Rewards: Diversifying Your Investment Portfolio

When it comes to securing your child's future, it is essential to consider the long-term financial implications. One effective strategy to mitigate risks and maximize rewards is by diversifying your investment portfolio.

By diversifying, you spread your investments across various asset classes, industries, and geographical locations. This approach helps reduce the potential impact of any single investment's negative performance on your overall portfolio. Diversification generally involves investing in different types of assets, such as stocks, bonds, real estate, and commodities. It also includes allocating funds to investments with varying levels of risk and return potential.

Risk management

Diversifying your investment portfolio helps manage risks. By allocating your resources to a range of investments, you decrease the likelihood that a single event or market sector will significantly affect your overall financial situation. It acts as a safety net, shielding your portfolio against potential losses due to market volatility or economic downturns.

Potential for higher returns

While diversification aims to minimize risk, it also offers the potential for higher returns. By investing across different sectors and asset classes, you increase the likelihood of capturing growth opportunities in various markets. This diversification allows you to take advantage of favorable economic conditions and potentially maximize your investment returns.

Consideration of different time horizons

When diversifying your portfolio, it is crucial to consider different time horizons. Some investments, such as stocks, may offer higher returns over an extended period but also involve higher short-term risks. Other options, like bonds, may provide more stable returns but lower long-term growth potential. Balancing these investments based on your specific goals and risk tolerance is key to achieving a diversified portfolio that suits your financial objectives.

Professional guidance

Building a diversified investment portfolio requires careful analysis and expertise. Seeking guidance from a financial advisor or investment professional can provide valuable insights and help you make informed decisions. These professionals can offer tailored advice, taking into account your unique circumstances, investment goals, and risk appetite.

In conclusion, diversifying your investment portfolio is an effective strategy for balancing risks and rewards when securing your child's future. By spreading your investments across different asset classes, industries, and time horizons, you can potentially optimize your returns while minimizing the impact of market fluctuations. Seeking professional guidance can further enhance your chances of building a well-rounded and resilient portfolio.

Navigating the Real Estate Market for Future Stability

In this section, we will explore effective strategies and insightful tips to successfully navigate the ever-changing real estate market with the objective of securing a stable and prosperous future.

- Understanding the Market Trends: Gain knowledge and insights into the current and future trends of the real estate market. This will enable you to make informed decisions and take advantage of opportunities that arise.

- Building a Diverse Portfolio: Invest in a variety of real estate assets, such as residential properties, commercial spaces, or even rental properties. Diversifying your portfolio will help minimize risks and maximize potential returns.

- Researching Potential Locations: Thoroughly research potential locations before making any investments. Factors such as proximity to amenities, transportation links, and growth potential should be taken into consideration to ensure long-term stability and appreciation.

- Working with Experienced Professionals: Collaborate with experienced real estate agents, financial advisors, and legal experts who can provide valuable guidance and assistance throughout the process. Their expertise will help you make sound decisions and avoid potential pitfalls.

- Developing a Financial Plan: Create a detailed financial plan that outlines your goals, budget, and timeline. This will help you stay organized and focused on achieving your objectives, while also allowing for adjustments as needed.

- Exploring Financing Options: Consider various financing options available to you, such as mortgages or loans, to fund your real estate investments. Exploring different avenues will help you secure the most favorable terms and ensure a sustainable approach to building your portfolio.

- Managing Risks and Returns: Develop a comprehensive risk management strategy to protect your investments and mitigate potential losses. Regularly review and assess the performance of your real estate assets to identify opportunities for optimization and growth.

By implementing these practical tips and insights, you will be equipped with the knowledge and strategies necessary to navigate the real estate market and secure a stable future for you and your loved ones.

Creating a Will and Estate Plan: Safeguarding Your Son's Inheritance

Ensuring that your son's inheritance is protected and distributed according to your wishes is a crucial step in securing his financial future. This section will guide you through the process of creating a will and estate plan, providing you with the necessary knowledge and tools to safeguard your son's inheritance.

| Benefits of Creating a Will and Estate Plan |

|---|

1. Preservation of Assets: By creating a will and estate plan, you can strategically allocate your assets to ensure their preservation and minimize the tax burden on your son's inheritance. |

2. Designating Guardianship: In your will, you can appoint a trusted individual to act as your son's guardian, ensuring his well-being in the event of your untimely demise. |

3. Avoiding Conflict: A well-drafted will can help prevent disputes among family members and other potential beneficiaries, ensuring a smooth transfer of your assets to your son. |

Creating a will and estate plan requires careful consideration and attention to detail. Here are some key steps to help you get started:

| Steps to Create a Will and Estate Plan |

|---|

1. Identify Your Assets: Make a comprehensive list of your assets, including properties, investments, bank accounts, and personal belongings. This will serve as the foundation for your estate plan. |

2. Choose an Executor: Select someone you trust to be the executor of your will. This individual will be responsible for ensuring that your assets are distributed according to your wishes. |

3. Specify Beneficiaries: Clearly outline who will inherit your assets and in what proportions. Consider any specific requirements or conditions you may have regarding the distribution of your estate. |

4. Consult with Professionals: Seek guidance from an experienced estate planning attorney or financial advisor to ensure that your will and estate plan align with legal requirements and best practices. |

5. Update Regularly: Review and update your will and estate plan periodically to reflect any changes in your financial situation, family dynamics, or personal preferences. |

By taking the necessary steps to create a will and estate plan, you can have peace of mind knowing that your son's inheritance will be protected and seamlessly transferred to him, establishing a solid foundation for his future financial security.

FAQ

How can I ensure a secure future for my son?

Ensuring a secure future for your son requires a combination of financial planning, education, and guidance. It is important to start saving early, considering long-term investments, such as a college fund or savings account. Additionally, providing your son with a good education and teaching him important life skills can greatly contribute to his future success.

What role does education play in securing my son's future?

Education plays a crucial role in securing your son's future. By providing a good education, you equip him with the knowledge and skills to pursue a successful career. It opens up opportunities for higher-paying jobs and increases his chances of financial stability. Moreover, education promotes personal growth, critical thinking, and lifelong learning, which are essential for adapting to a changing world.

Is it necessary to involve a financial advisor to secure my son's future?

While involving a financial advisor is not necessary, it can be beneficial in securing your son's future. A financial advisor can provide valuable advice and expertise in creating a comprehensive financial plan tailored to your specific goals and circumstances. They can help you navigate investment options, tax planning, and retirement planning, ensuring that you make informed decisions to maximize your son's financial security.