Are you tired of feeling restricted by your current financial situation? Do you yearn for the freedom to pursue your dreams and live the life you've always imagined? If so, then it's time to unlock the untapped potential within you and take control of your financial future.

In today's world, money plays a vital role in every aspect of our lives. From education to healthcare, from travel to leisure activities, our dreams and aspirations often hinge on our ability to access the necessary funds. However, many individuals find themselves trapped in a cycle of financial limitations, unable to break free and reach their full potential.

But what if there was a way to change that? What if you could transform your financial situation and open doors that were previously closed to you? The answer lies in understanding the power of loans and how they can propel you towards the life you desire.

Loans have long been regarded as a valuable tool for bridging the gap between where you are now and where you want to be. Whether you're looking to start a business, pursue higher education, or simply consolidate existing debts, loans offer a means to access the funds necessary to make your dreams a reality.

But loans are more than just a financial transaction - they represent a profound opportunity for personal growth and empowerment. By taking control of your financial destiny and strategically utilizing loans, you can unlock a world of possibilities and maximize your potential.

Understanding Loans: A Key to Achieving Financial Freedom

Exploring the fundamentals of borrowing money is an indispensable step towards attaining financial independence. By comprehending the intricacies of loans, individuals can gain valuable insights into unlocking their financial potential and establishing a stable economic foundation.

An Insightful Overview

Understanding the concept of loans goes beyond a mere knowledge of borrowing money: it encompasses the ability to analyze and evaluate various loan options available in the market. Familiarizing oneself with the terminology associated with loans, such as interest rates, repayment terms, and collateral, equips individuals with the necessary tools to make informed financial decisions.

Empowering Financial Decision-Making

Mastering the intricacies of loans empowers individuals to make confident and strategic choices concerning their financial well-being. By recognizing the different types of loans, including personal loans, student loans, and mortgages, individuals can tailor and align their financial goals with the loan options that best suit their needs. Moreover, understanding how loans function in relation to credit scores and financial history allows individuals to actively improve their financial health.

Building a Strong Financial Foundation

Acquiring a comprehensive understanding of loans is akin to constructing a sturdy financial foundation. It enables individuals to establish budgets, manage debt, and lay a solid groundwork for future wealth accumulation. By utilizing loans wisely and being mindful of their potential risks, individuals can navigate their financial journey with a sense of control, balance, and long-term sustainability.

In conclusion, familiarizing oneself with the complexities of loans is a crucial step towards achieving financial freedom. By understanding the intricacies of borrowing and utilizing loans strategically, individuals can unlock their financial potential and pave the way for a secure and prosperous future.

The Advantages of Borrowing Funds: Bringing Your Aspirations to Reality

When it comes to realizing our ambitions and turning our visions into actual achievements, sometimes we require additional financial assistance. One effective means of obtaining the necessary funds is through borrowing money. This section explores the various benefits associated with borrowing and how it can empower individuals to fulfill their dreams.

1. Progression towards personal goals: Borrowing enables individuals to access funds that can be utilized to pursue personal endeavors. Whether it's starting a new business, funding higher education, or embarking on a long-awaited adventure, loaning money provides the means to turn aspirations into tangible realities. |

2. Flexibility in financial decision-making: By opting for loans, individuals gain the flexibility to make important financial choices without being constrained by limited resources. This newfound freedom allows them to seize opportunities and venture into new territories that could potentially reap considerable rewards. |

3. Building a strong credit history: Borrowing money responsibly and repaying it on time contributes to the establishment of a solid credit history. A positive credit record is vital for future financial endeavors, such as obtaining lower interest rates on future loans or securing more favorable terms. |

4. Overcoming financial obstacles: Borrowing can provide a lifeline during challenging times when unexpected expenses arise or when faced with financial emergencies. It serves as a safety net that allows individuals to navigate through difficult circumstances, preserving their overall financial well-being. |

In conclusion, borrowing money offers numerous advantages, empowering individuals to transform their dreams into concrete accomplishments. By embracing the opportunities that borrowing provides, one can embark on a path towards personal growth, financial stability, and the fulfillment of long-held aspirations.

Choosing the Right Loan: A Guide to Finding the Perfect Fit

Exploring the ideal loan option is a crucial step towards achieving your financial goals. Successfully navigating the world of loans involves careful consideration and understanding of various factors. In this section, we will provide you with valuable insights and tips on how to select the loan that best suits your needs.

1. Determine your loan purpose:

- Identify your specific financial requirements and goals

- Consider the purpose of the loan, whether it is for education, home improvement, business expansion, or debt consolidation

- Evaluate the urgency and timeframe for obtaining the loan

2. Understand the types of loans available:

- Explore different loan options, such as personal loans, mortgage loans, student loans, and business loans

- Research the characteristics, terms, and conditions of each loan type

- Compare the interest rates, repayment plans, and eligibility criteria offered by different lenders

3. Assess your financial capability:

- Calculate your current and future income

- Analyze your expenses and debt obligations

- Consider your credit history and credit score

4. Research and compare lenders:

- Investigate various lenders, including traditional banks, credit unions, and online lending platforms

- Read customer reviews and ratings to gauge their reputation and credibility

- Compare interest rates, fees, and repayment terms

5. Consult with financial advisors:

- Seek advice from professionals who specialize in financial planning

- Discuss your loan options and goals with a knowledgeable advisor

- Consider their recommendations and insights before making a decision

By following these steps, you will be equipped with the necessary knowledge to find the perfect loan that aligns with your financial objectives and sets you on the path to success.

Managing Your Loan: Strategies for Repaying Debt and Establishing Good Credit

Once you have obtained a loan and are ready to start working towards financial stability, it is important to have a solid plan in place to manage your loan effectively. This section will provide you with valuable tips and recommendations on how to pay off your debt efficiently while simultaneously building a positive credit history.

1. Create a Budget: Establishing a comprehensive budget is crucial when it comes to managing your loan. Take the time to carefully analyze your income and expenses, and identify areas where you can potentially cut back on unnecessary spending. By allocating your resources wisely, you can allocate a portion of your income towards repaying your loan each month.

2. Prioritize Your Debts: If you have multiple loans or debts, it is essential to prioritize them based on interest rates and repayment terms. Focus on paying off high-interest debts first while making consistent minimum payments on other obligations. By tackling the highest interest debts first, you can ultimately save money in the long run.

3. Create an Emergency Fund: Unexpected expenses can arise at any time, leading to financial stress and potentially derailing your debt repayment efforts. By setting aside a portion of your income into an emergency fund, you can create a safety net to handle unforeseen expenses without turning to additional loans or credit cards.

4. Pay More than the Minimum: While it may be tempting to only make the minimum payments on your loans, making additional payments whenever possible can significantly reduce the time it takes to pay off your debt. By paying more than the required amount, you can save on interest charges and ultimately become debt-free sooner.

5. Monitor your Credit Score: Your credit score plays a crucial role in demonstrating your creditworthiness to lenders and financial institutions. Regularly monitoring your credit score and taking steps to improve it, such as making payments on time and reducing your credit utilization, can help you build a positive credit history and open doors to better loan opportunities in the future.

6. Seek Professional Advice: If you find managing your loan overwhelming or if you feel you need additional guidance, don't hesitate to seek advice from a financial professional. They can help you create a personalized plan tailored to your unique financial situation and provide expertise to help you successfully manage your loan.

In summary, effectively managing your loan involves creating a budget, prioritizing debts, creating an emergency fund, making more than the minimum payments, monitoring your credit score, and seeking professional advice when needed. By implementing these strategies, you can take control of your financial future, pay off your debt, and build a strong credit foundation.

Common Mistakes to Avoid When Borrowing Money: Valuable Insights from Financial Experts

When it comes to obtaining a loan, it is crucial to navigate the process wisely in order to achieve your financial goals. In this section, we will explore some of the common mistakes that borrowers make and learn from the expertise shared by financial professionals. By avoiding these pitfalls, you can maximize the benefits of borrowing and ensure a more secure financial future.

1. Neglecting to thoroughly research and compare loan options: One of the common blunders borrowers commit is not dedicating ample time to research and compare various loan options available to them. By failing to do so, borrowers may end up obtaining a loan with unfavorable terms and conditions, resulting in higher interest rates and unnecessary financial burden. It is essential to evaluate multiple lenders, consider their reputation, interest rates, repayment terms, and fees, and choose the option that aligns best with your financial situation.

2. Overborrowing: Another mistake borrowers often fall prey to is overborrowing. It can be tempting to request more money than what is actually needed, especially if the lender is willing to provide it. However, borrowing more than necessary can lead to increased debt and difficulties in repayment. It is vital to carefully assess and calculate your actual financial requirements before deciding on the loan amount, ensuring that you only borrow what is essential.

3. Ignoring the fine print: Many borrowers make the error of not carefully reading and understanding the terms and conditions of the loan agreement. The fine print contains important details regarding interest rates, repayment schedules, penalties, and any additional fees. Failure to review these terms can result in unpleasant surprises, such as unexpected fees or penalties for early repayment. Take the time to thoroughly read and comprehend the contract, seeking clarity from the lender if needed, to avoid any future complications.

4. Failing to consider the impact on credit score: Borrowing money can have a significant impact on your credit score. Late or missed payments can lead to a decrease in your creditworthiness and affect your ability to obtain future loans. It is crucial to make timely repayments and prioritize loan obligations to maintain a healthy credit score. Additionally, applying for multiple loans simultaneously can also negatively impact your creditworthiness. It is advisable to be cautious and strategic when seeking multiple loans.

5. Disregarding the importance of a repayment plan: Having a well-defined repayment plan in place is essential before borrowing money. Many borrowers overlook the significance of planning how they will repay the loan, leading to difficulties in meeting their financial obligations. It is crucial to create a budget, allocate funds specifically for loan repayment, and ensure consistency in making timely payments. By properly managing your finances and adhering to a repayment plan, you can avoid unnecessary stress and maintain financial stability.

In conclusion, by being aware of the common loan mistakes and learning from the insights provided by financial experts, you can make informed decisions when borrowing money. Thorough research, responsible borrowing, attention to detail, credit score management, and a well-structured repayment plan are key factors to bear in mind. By avoiding these mistakes, you will be better equipped to unlock your financial potential and achieve your financial goals.

Exploring Non-Traditional Loan Options: Embracing Innovative Approaches

Many individuals often find themselves in need of financial support outside the conventional loaning system. In such scenarios, it becomes crucial to expand our horizons and explore alternative options that can provide the necessary funds. By thinking outside the box, one can uncover unique and innovative approaches to borrowing money that may better suit their specific needs and circumstances.

Exploring Peer-to-Peer Lending: One increasingly popular alternative loan option is peer-to-peer lending. This form of lending connects borrowers directly with individual lenders or groups of investors. By bypassing traditional financial institutions, borrowers can potentially secure more favorable interest rates and terms, while investors can earn competitive returns on their investment. Peer-to-peer lending platforms offer opportunities for both individuals and businesses to access funds in a transparent and efficient manner.

Considering Microfinance Institutions: Another alternative to traditional loaning is exploring microfinance institutions. These organizations provide financial services to individuals who are excluded from the conventional banking system due to various reasons, such as lack of collateral or limited credit history. Microfinance institutions offer small loans, typically tailored to support entrepreneurship and self-employment ventures in developing economies. Through their unique approach, they empower individuals to pursue their dreams and improve their financial well-being.

Embracing Crowdfunding: Crowdfunding is yet another alternative loan option that has gained significant popularity in recent years. This innovative concept allows individuals to raise funds for their projects or initiatives by obtaining contributions from a large number of people, often through online platforms. Crowdfunding promotes community involvement and enables individuals to bring their creative ideas to life, without having to rely on traditional lending institutions. It opens up new possibilities for funding unique ventures and connecting with like-minded individuals who believe in their vision.

Exploring Alternative Loan Options: In today's rapidly evolving financial landscape, it is essential to keep an open mind and explore alternative loan options beyond the traditional channels. By delving into peer-to-peer lending, microfinance institutions, or crowdfunding, individuals can unlock a world of potential funding opportunities tailored to their specific needs. Embracing these innovative approaches allows one to take control of their financial future and create a path towards achieving their dreams.

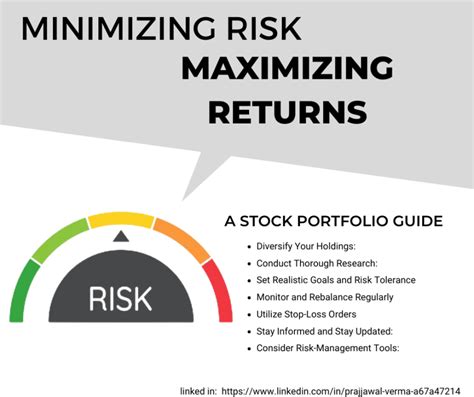

Investment Loans: Maximizing Returns and Minimizing Risks

When it comes to exploring opportunities for financial growth, the utilization of investment loans offers a promising avenue to maximize returns on investment while simultaneously minimizing associated risks. This section delves into the strategic approach of utilizing loaned funds for investment purposes, shedding light on how to achieve optimal financial outcomes by intelligently navigating the investment landscape.

Investing in Your Future: The Power of Loaning Money for Education

Unlocking the potential for a brighter future

Embarking on a journey of higher education is an invaluable investment in one's future. It opens up a world of opportunities, broadens horizons, and equips individuals with the knowledge and skills necessary to thrive in today's competitive landscape. However, the cost of pursuing education can often pose a significant barrier for many aspiring learners. This is where loaning money for education emerges as a powerful tool to overcome financial obstacles and empower individuals to unlock their full potential.

Empowering individuals through financial assistance

Loaning money for education presents a unique opportunity to invest in oneself. By seeking financial assistance, individuals can access the resources needed to pursue their educational dreams without being hindered by immediate financial constraints. This form of investment not only provides the means to cover tuition fees but also enables access to comprehensive educational experiences, such as study abroad programs, internships, and research opportunities.

Building a pathway to lifelong success

One's educational journey is not merely confined to a limited period. Rather, it serves as a foundation for lifelong success and personal growth. By taking advantage of loans for education, individuals can harness the power of knowledge to secure better career prospects, increased earning potential, and enhanced job security. This investment in education paves the way for long-term financial stability, independence, and the ability to contribute meaningfully to society.

Overcoming potential misconceptions

While the notion of loaning money for education may seem daunting to some, it is essential to dispel common misconceptions. With responsible financial planning, diligent research on loan options, and a thorough understanding of loan terms, individuals can make informed decisions that align with their long-term goals. It is crucial to recognize that an investment in education is an investment in oneself, with the potential for far-reaching benefits that transcend the financial realm.

Conclusion

Loaning money for education offers individuals a transformative opportunity to invest in their future. By unlocking access to education, this financial avenue empowers individuals to broaden their horizons, maximize their potential, and create a pathway to lifelong success. It is a powerful tool that allows individuals to overcome financial barriers and reap the long-term rewards of education, both personally and professionally.

The Emotional Aspect of Lending Money: Conquering Apprehension and Taking the Plunge

When it comes to the intricate world of personal finance, there is often an undeniable emotional component that influences our decisions, particularly when it comes to the delicate matter of loaning money. Overcoming fear and embracing the opportunities that lending can bring can be a vital step towards realizing our full potential in managing our finances.

Overcoming Fear: Embracing New Perspectives

The initial fear of loaning money is often rooted in uncertainty and the possibility of financial risk. However, it is crucial to recognize that borrowing can also present a valuable opportunity for growth and achieving our goals. By reframing our perspective and recognizing that loans can serve as a powerful tool for unlocking potential, we can begin to conquer our apprehensions and embrace the possibilities.

Building Trust: Establishing a Solid Foundation

One of the key factors that contribute to the fear of lending money is a lack of trust. Whether it is a fear of not being able to repay the loan or skepticism about the lender's intentions, building trust is essential for overcoming these emotional barriers. By thoroughly researching potential lenders, seeking recommendations, and establishing open communication, we can lay the groundwork for a transparent and reliable lending relationship.

Financial Freedom: Empowering Yourself through Responsible Borrowing

While the concept of borrowing money may initially seem intimidating, it is important to recognize that responsible borrowing can actually empower us to achieve greater financial freedom. By using loans strategically and thoughtfully, we can leverage opportunities that would otherwise be out of reach. The key lies in careful planning, budgeting, and maintaining a healthy balance between borrowing and saving.

In conclusion, embracing the emotional side of loaning money requires overcoming fear, building trust, and recognizing the potential for financial growth and freedom. By acknowledging these emotional aspects and approaching borrowing with responsibility and strategic planning, we can take the leap towards unlocking our financial potential and achieving our dreams.

FAQ

What are the benefits of loaning money to fulfill your dreams?

Loan can provide you with the necessary funds to pursue your dreams, whether it's starting a new business, going on a dream vacation, or buying a new house. It allows you to unlock your financial potential and achieve your goals.

Are there any risks involved in taking a loan?

Yes, there are risks involved in taking a loan. If you fail to repay the loan on time, it can negatively impact your credit score and financial stability. It's important to carefully assess your financial situation and ability to repay the loan before taking one.

What factors should be considered before taking a loan?

Before taking a loan, you should consider factors such as your credit score, interest rates, repayment terms, and any additional fees or charges associated with the loan. It's important to fully understand the terms and conditions of the loan before making a decision.

How can I improve my chances of getting approved for a loan?

To improve your chances of getting approved for a loan, you can work on improving your credit score, paying off any outstanding debts, and providing necessary documentation to support your income and financial stability. It's also important to shop around and compare different lenders to find the best loan terms for your situation.

What alternatives should I consider before taking a loan?

Before taking a loan, you should consider alternatives such as saving money, seeking financial assistance from family or friends, or exploring crowdfunding options. These alternatives can help you avoid taking on additional debt and potential financial risks.

What does it mean to dream of loaning money?

Dreaming of loaning money may symbolize your desire for financial assistance or your willingness to take on financial responsibilities. It can also reflect your concerns or fears about money and debt.