Unlocking the doors to a life of wealth and prosperity lies within the realm of infinite possibilities. Setting sail on the vast ocean of financial independence, one can navigate through the currents of ambition and perseverance. Empowered by an unwavering determination and a deep-rooted desire for success, countless individuals dare to dream beyond the boundaries of conventional wealth and monetary achievements.

Embrace the idea of self-reliance and the pursuit of financial security as you embark on a liberating journey towards amplifying your financial acumen. Unleashing your potential to harness the forces of opportunity, you will encounter a myriad of pathways that lead to the fulfillment of your unique aspirations. Empower yourself to manifest your vision of financial autonomy by stepping out of the shadows of financial stability and venturing into the realm of possibility.

The road to financial empowerment demands a thoughtful approach, fueled by innovation and propelled by resourcefulness. With unwavering commitment, one must embrace the art of strategic decision-making and learn to capitalize on emerging trends. Navigate through the ever-changing landscapes of wealth management and unleash the potential of your instinctual prowess to cultivate a future of abundance. Arm yourself with the knowledge, skills, and tools necessary to shape your own destiny, crafting a legacy that transcends conventional limitations.

Understanding Your Financial Independence Objectives

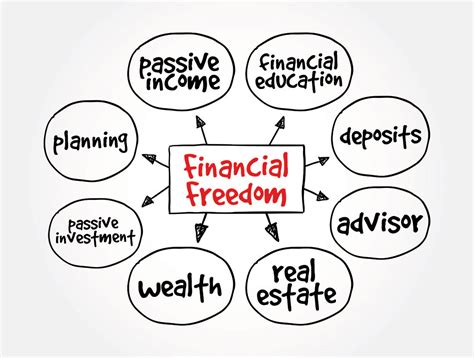

When it comes to achieving your aspirations for financial freedom, it is crucial to have a clear understanding of your objectives. These objectives serve as the guiding force that shapes your path towards financial independence. By comprehending your goals, you can develop effective strategies and make informed decisions that will lead you closer to achieving financial stability and autonomy.

- Define Your Ambitions: Take a moment to reflect on what you aspire to accomplish financially. Consider the lifestyle you desire, the level of financial security you aim for, and the opportunities you want to pursue. Identifying your ambitions will help you establish specific targets to work towards and provide you with a sense of purpose and direction.

- Establish Priorities: Once you have a clear vision of your financial goals, it is essential to prioritize them. Determine which objectives are most important to you and require immediate attention. By establishing priorities, you can allocate your resources and efforts effectively, ensuring that you make progress in line with your aspirations.

- Set Realistic and Measurable Targets: To make substantial progress towards financial independence, it is essential to set specific, achievable, and measurable targets. These targets will enable you to track your progress and make necessary adjustments along the way. By breaking down your larger goals into smaller milestones, you can stay motivated and celebrate your achievements as you move forward.

- Consider Timeframes: Timeframes play a vital role in goal setting. Determine the timeframe within which you aim to accomplish each financial objective. It is important to strike a balance between setting realistic deadlines and challenging yourself to achieve results within a reasonable time frame. This will help you maintain focus and consistently work towards your goals.

- Align Your Resources: Achieving financial independence often requires the utilization of various resources. Assess the tools, skills, and knowledge you currently possess, and identify any gaps that need to be filled. Consider obtaining the necessary education or seeking professional advice to ensure you are equipped with the right resources to achieve your financial goals.

- Review and Adapt: As you progress on your journey towards financial independence, it is crucial to regularly review your objectives and adjust them as needed. Life circumstances and priorities change, and it is important to be adaptable and flexible. Regularly evaluating your goals allows you to stay aligned with your aspirations and make strategic decisions to continue moving forward.

By understanding your financial independence goals, you can chart a clear path towards realizing your dreams of a secure and self-sufficient financial future. Take the time to reflect, prioritize, set targets, consider timeframes, align your resources, and review your goals regularly. With determination and focus, you can be well on your way to achieving the financial independence you desire.

Crafting a Personalized Financial Plan

Creating a unique blueprint to achieve one's financial aspirations involves careful planning and strategizing. This section explores the importance of crafting a personalized financial plan tailored to your specific needs and desires.

1. Assess Your Current Financial Situation:

- Take an in-depth look at your current financial state, including your income, expenses, and existing assets.

- Analyze your spending habits and identify areas where you can potentially save or cut back.

- Evaluate any outstanding debts or loans and develop a plan to manage or eliminate them.

2. Define Your Financial Goals:

- Clearly articulate your short-term and long-term financial objectives.

- Consider both monetary goals, such as saving for a down payment or retirement, as well as non-monetary goals, such as starting a business or traveling the world.

- Ensure your goals are specific, measurable, achievable, relevant, and time-bound (SMART).

3. Create a Budget:

- Establish a comprehensive budget that aligns with your financial goals.

- Categorize your expenses and allocate funds accordingly.

- Regularly monitor and review your budget to make necessary adjustments.

4. Identify Income-Boosting Opportunities:

- Explore potential avenues to increase your income, such as pursuing additional education, acquiring new skills, or exploring side hustles.

- Consider investment opportunities that have the potential for long-term financial growth.

- Maximize your earning potential by seeking promotions or salary negotiations.

5. Implement Saving and Investment Strategies:

- Develop a savings plan that aligns with your financial goals, automating regular contributions to ensure consistency.

- Explore different investment options, such as stocks, bonds, mutual funds, or real estate, based on your risk tolerance and time horizon.

- Diversify your investment portfolio to minimize risk and maximize potential returns.

Crafting a personalized financial plan is a crucial step towards achieving financial security and realizing your dreams. By assessing your current situation, setting clear goals, creating a budget, identifying income-boosting opportunities, and implementing saving and investment strategies, you can pave the way for a prosperous future.

Effective Strategies for Saving and Investing

When it comes to achieving financial stability and reaching your desired financial goals, it is crucial to adopt effective strategies for saving and investing your hard-earned money. By implementing smart financial decisions and making informed choices, you can pave the path towards long-term financial security.

A key aspect of successful money management is saving. Saving involves setting aside a portion of your income for future use, allowing you to build an emergency fund and work towards your financial objectives. One effective strategy for saving is creating a budget that outlines your income, expenses, and savings goals. This budget can help you identify areas where you can cut back on unnecessary expenses and allocate more towards savings.

In addition to saving, investing is another powerful tool for achieving financial growth. Investing involves putting your money into assets such as stocks, bonds, or real estate with the expectation of earning a profitable return over time. A diversified investment portfolio can help you spread the risk and potentially maximize your returns. It is important to conduct thorough research and seek professional advice before diving into any investment opportunities.

One strategy for successful investing is dollar-cost averaging. This approach involves investing a fixed amount of money at regular intervals, regardless of market conditions. By consistently investing over time, you can potentially benefit from purchasing more shares when prices are low and fewer shares when prices are high. This strategy helps to mitigate the impact of market volatility and takes advantage of the long-term growth potential of the market.

Furthermore, it is crucial to stay informed about the latest financial trends and constantly educate yourself about investment strategies. By staying up to date with market developments, economic indicators, and financial news, you can make more informed decisions and adjust your investment approach as needed. Additionally, exploring different investment options and understanding the risks and potential returns associated with each can help you make more calculated investment decisions.

| Key Takeaways: |

|---|

| - Prioritize saving and create a budget to allocate funds towards your financial goals. |

| - Diversify your investment portfolio to spread risk and potentially maximize returns. |

| - Consider employing dollar-cost averaging to reduce the impact of market volatility. |

| - Stay informed about financial trends and educate yourself on investment strategies. |

| - Seek professional advice and conduct thorough research before making investment decisions. |

Breaking Free from Debt: Tips and Tricks

Discover strategies and techniques to liberate yourself from the burden of debt and achieve financial freedom through the implementation of effective tips and tricks. This section will provide practical advice and actionable steps that can help you take control of your finances and break free from the cycle of debt.

- Create a Budget: Start by assessing your income and expenses to develop a comprehensive budget. This will help you understand where your money is going and identify areas where you can cut back.

- Reduce Expenses: Look for opportunities to trim unnecessary expenses and identify areas where you can make cost-saving changes. Consider alternatives to high-priced items or services and prioritize your spending.

- Consolidate Debts: Explore options to consolidate your debts into one manageable payment. This can simplify your finances and potentially lower your interest rates, helping you pay off your debt faster.

- Negotiate with Creditors: Reach out to your creditors and negotiate for lower interest rates or extended payment terms. Many creditors are willing to work with you if you demonstrate a commitment to paying off your debts.

- Focus on High-Interest Debts: Prioritize paying off debts with high-interest rates first to minimize the amount of interest you accumulate over time. This approach can save you money and help you break the debt cycle more quickly.

- Seek Professional Help: Consider consulting with a financial advisor or credit counselor who can provide expert guidance tailored to your specific situation. They can help you develop a personalized debt repayment plan and provide ongoing support.

- Track Your Progress: Monitor your debt repayment progress regularly to stay motivated and celebrate milestones along the way. Use tools such as spreadsheets or mobile apps to track your payments and see how far you've come.

By implementing these tips and tricks, you can gradually break free from debt and pave the way towards achieving your financial goals. Remember, financial freedom is within reach with dedication and perseverance.

Building Multiple Streams of Income

Creating diverse sources of revenue is a key component of achieving financial prosperity and securing a stable financial future. By establishing multiple streams of income, individuals can minimize their dependence on a single source and increase their potential for wealth accumulation.

Diversifying income

One strategy for building multiple streams of income is through diversification. This involves exploring various avenues, such as investing, entrepreneurship, or part-time work, to generate additional sources of revenue. By spreading income-generating activities across different sectors or industries, individuals can decrease their exposure to risks associated with economic fluctuations and industry-specific challenges.

Investment opportunities

Investing in different asset classes, such as stocks, bonds, real estate, and commodities, can provide passive income streams. Diversifying investments helps distribute risk and increases the potential for earning returns from multiple sources simultaneously. Additionally, exploring alternative investment options, such as peer-to-peer lending or venture capital investments, can further diversify income and expand the chances of financial success.

Entrepreneurship

Starting a business or engaging in freelancing allows individuals to create their own income streams and exercise control over their financial destiny. Operating a successful business can generate substantial profits and provide a flexible work schedule. Additionally, developing multiple entrepreneurial ventures in different industries or niches can mitigate the risk of relying solely on one business.

Part-time work and side hustles

Engaging in part-time work or pursuing side hustles outside of regular employment can provide additional sources of income. Taking on freelance projects, consulting work, or leveraging in-demand skills can boost earning potential while offering flexibility and autonomy. Furthermore, exploring the gig economy or online platforms can unlock opportunities to generate income on a flexible and part-time basis.

Passive income streams

Creating passive income streams can be another effective way to build multiple sources of revenue. This can involve investing in dividend-paying stocks, rental properties, or establishing royalty arrangements for creative works. Passive income requires an upfront investment of time or capital but can generate ongoing income with minimal effort once established.

In conclusion,

Building multiple streams of income is an essential part of attaining financial stability and achieving long-term financial goals. Diversifying income through various strategies, such as investments, entrepreneurship, part-time work, and passive income streams, can broaden earning potential and provide a solid foundation for financial independence.

Navigating the Stock Market: A Beginner's Journey

Embarking on the exciting world of the stock market can be a captivating adventure in pursuit of financial growth. Through this beginner's guide, we will explore the essential concepts and strategies that will assist you in navigating the complex terrain of stock market investing.

| Key Topics Covered: |

|---|

| 1. Understanding Stock Market Basics |

| 2. Building a Solid Foundation |

| 3. Decoding Market Analysis |

| 4. Embracing Diversification |

| 5. Managing Risk and Setting Realistic Expectations |

Before delving into the intricacies of stock trading, it is crucial to comprehend the fundamental principles that govern the market. This section will provide a concise overview of the stock market, its participants, and the different types of securities traded.

Building a solid foundation is essential for any novice investor. We will explore the fundamental concepts, such as understanding stock exchanges, the role of brokers, and how to open and manage a brokerage account. Additionally, we will discuss the importance of setting clear investment goals and developing a well-defined investment strategy.

Decoding market analysis forms a crucial part of successful stock market navigation. We will delve into the various analysis techniques employed by traders to assess market trends and evaluate the performance of individual stocks. Technical analysis, fundamental analysis, and market indicators will be explored in detail.

Embracing diversification is a key strategy for reducing risk and maximizing returns. This section will provide insights into building a diverse portfolio by investing across different sectors, asset classes, and geographic locations. Additionally, we will discuss the benefits of both short-term and long-term investments.

Managing risk is a crucial aspect of stock market investing. We will explore risk management techniques such as setting stop-loss orders and employing various hedging strategies. Furthermore, we will emphasize the importance of setting realistic expectations and adopting a disciplined approach to investment.

By acquiring the knowledge and implementing the strategies discussed in this beginner's guide, you will be equipped with the essential tools to navigate the stock market successfully. Remember, achieving financial growth through stock market investing requires continuous learning, adaptability, and a long-term perspective.

Unleashing the Potential of Passive Income

Discover the untapped power of generating income without actively trading time for money. In this section, we delve into the concept of passive income and how it can reshape your financial future. Explore the various avenues available for creating passive income streams and learn how to leverage them to achieve financial stability and freedom.

1. Diversify Your Income Portfolio

- Explore different passive income opportunities to reduce reliance on a single source of income.

- Discover various investment vehicles, such as stocks, bonds, real estate, and more.

- Understand the benefits of diversification and how it can help you minimize risks and maximize returns.

2. Creating and Monetizing Intellectual Property

- Tap into your creativity by producing and selling original content, such as books, music, artwork, or software.

- Learn the steps involved in copyrighting and protecting your intellectual property.

- Discover platforms and strategies for monetizing your creations and turning them into passive income streams.

3. Building and Managing a Passive Real Estate Portfolio

- Gain insights into the world of real estate investing and its potential for generating passive income.

- Understand different real estate investment strategies, including rental properties, REITs, and real estate crowdfunding.

- Learn tips for effectively managing and growing your passive real estate portfolio.

4. Maximizing Returns through Dividend Investing

- Discover the power of dividend investing and how it can create a steady stream of passive income.

- Understand the key factors to consider when selecting dividend-paying stocks.

- Learn techniques for maximizing returns and managing risks in dividend investing.

5. Exploring the World of Online Business and Affiliate Marketing

- Uncover the opportunities presented by the digital era and the potential of online businesses.

- Learn about affiliate marketing and how it allows you to earn passive income by promoting products and services.

- Discover strategies for setting up and scaling an online business to generate consistent passive income.

By understanding and harnessing the power of passive income, you can unlock financial flexibility, create wealth, and work towards achieving economic freedom. The possibilities are endless when you unleash the potential of passive income to support your financial goals.

The Significance of Diversifying Your Investments

One crucial aspect of successfully managing your finances is the significance of diversifying your investments. While it may be tempting to focus solely on a single potential lucrative endeavor, putting all your eggs in one basket can expose you to unnecessary risks. By spreading your investments across various assets and markets, you can mitigate potential losses and increase the likelihood of achieving your financial goals.

When contemplating the importance of diversification, it is crucial to recognize that different investments perform differently under various market conditions. By investing in a diverse range of assets, such as stocks, bonds, real estate, and commodities, you can reduce the impact of a single investment's poor performance on your overall portfolio. Diversification allows you to benefit from multiple income streams and minimize the chances of suffering substantial financial setbacks due to market fluctuations.

Furthermore, diversifying your investments helps you avoid the risks associated with putting all your financial resources into a single industry or sector. A well-diversified portfolio can help safeguard against unexpected industry-specific downturns, as losses from one sector may be offset by gains in another. By spreading your investments across multiple sectors, you can insulate yourself from the negative effects of market volatility and decrease the overall risk profile of your portfolio.

Another advantage of diversification is the potential for higher long-term returns. While some investments may experience fluctuations in value over time, a diversified portfolio has the potential to generate consistent returns by taking advantage of a variety of investment opportunities. Additionally, diversification can provide a sense of stability and peace of mind, knowing that your financial future is not solely reliant on the performance of a single investment.

- Diversification helps mitigate risk

- Investing in different asset classes reduces the impact of market fluctuations

- Avoiding industry-specific risks by diversifying across sectors

- Potential for higher long-term returns

- Increased stability and peace of mind

In conclusion, diversifying your investments is a key factor in achieving financial success and independence. By spreading your investments across various assets, sectors, and markets, you can protect yourself against unexpected downturns, reduce risk, and potentially increase long-term returns. Remember, a well-diversified portfolio is a vital step towards attaining your financial goals.

Breaking Down Mental Obstacles to Attain Financial Freedom

Overcoming psychological hurdles is crucial when striving towards economic autonomy. In this section, we delve into the various mental barriers that individuals often face while pursuing financial self-sufficiency, and explore effective strategies for conquering these obstacles.

1. Shifting Mindset: Transforming Limiting Beliefs One of the foremost challenges on the path to financial freedom is shifting our mindset by identifying and challenging our self-limiting beliefs. These ingrained thoughts can create a mental barrier that hinders our ability to make sound financial decisions or take calculated risks. By embracing a growth-oriented mindset, we can unlock our full potential and empower ourselves toward achieving our monetary objectives. |

2. Conquering Fear: Embracing Risk-Taking Fear of failure often acts as an obstacle to financial independence. However, taking calculated risks is an integral part of wealth creation. By acknowledging and addressing our fear, we can develop a mindset that accepts the inherent risks involved in financial ventures. This allows us to step outside of our comfort zones and seize opportunities that lead to financial growth. |

3. Building Resilience: Bouncing Back from Setbacks Setbacks and failures are inevitable on the journey toward financial independence. Developing resilience is essential in order to bounce back from these setbacks and persevere. Cultivating resilience involves fostering a positive attitude, learning from mistakes, and adapting our strategies accordingly. By viewing setbacks as learning experiences, we can maintain a resilient mindset that propels us closer to our financial goals. |

4. Overcoming Impulse and Instant Gratification Impulse spending and seeking instant gratification can hinder our progress towards financial independence. Overcoming these tendencies requires discipline, self-control, and the ability to delay gratification. By understanding the value of long-term financial stability and setting SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals, we can overcome impulsive behaviors and make informed financial decisions that lead to lasting prosperity. |

5. Seeking Knowledge: Investing in Financial Education Lack of knowledge and understanding regarding personal finance can serve as a significant mental barrier to financial independence. Investing in financial education equips us with the necessary tools to make informed decisions and handle our money effectively. By actively seeking out resources, such as books, courses, or professional advice, we can expand our financial literacy and overcome any mental obstacles that prevent us from achieving our financial objectives. |

Seeking Professional Assistance: Financial Advisors and Consultants

When it comes to reaching your financial aspirations, it can be beneficial to seek guidance from experts in the field. Financial advisors and consultants are professionals dedicated to helping individuals achieve their financial objectives and overcome monetary challenges.

Understanding the Role of Financial Advisors

Financial advisors are knowledgeable professionals who specialize in providing personalized financial guidance based on individual circumstances and goals. They possess a deep understanding of various aspects of finance, including investment strategies, retirement planning, risk management, and taxation.

By offering objective advice and conducting thorough analyses of your financial situation, financial advisors can help you develop a comprehensive plan to attain financial security. They take into account factors such as your risk tolerance, time horizon, and financial resources to create a tailored approach that aligns with your unique needs and aspirations.

The Benefits of Engaging a Financial Consultant

A financial consultant brings specialized expertise to the table, offering a broader range of services beyond traditional financial planning. These professionals not only assess your current financial situation but also analyze your overall financial structure, identifying areas where optimization or improvement may be necessary.

Apart from providing comprehensive financial advice, financial consultants can also assist with complex financial matters such as estate planning, tax planning, and business consulting. They serve as trusted partners who provide valuable insights and recommendations to help you navigate intricate financial decisions and maximize your wealth.

Choosing the Right Financial Advisor or Consultant

When selecting a financial advisor or consultant, it is crucial to consider their qualifications, experience, and areas of specialization. Look for professionals who hold recognized certifications, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA), as these designations indicate a high level of expertise and commitment to ethical standards.

Furthermore, take the time to research and interview multiple candidates, assessing their communication style, approach to financial planning, and fee structure. Personal compatibility and trust are essential elements in establishing a successful long-term partnership with a financial advisor or consultant.

In conclusion, seeking professional help from financial advisors and consultants can significantly aid in your journey towards achieving financial stability and realizing your wealth aspirations. These experts bring valuable knowledge, experience, and objective perspectives to help you navigate the complexities of personal finance effectively.

FAQ

How can I achieve financial independence?

Financial independence can be achieved by setting clear money goals, creating a budget, saving consistently, investing wisely, and minimizing debt. It requires discipline, perseverance, and a long-term mindset. It is important to analyze your spending habits, cut unnecessary expenses, and focus on increasing your income. By setting financial goals and developing a strategic plan, you can take small steps towards achieving financial independence.

Is it possible to achieve financial independence with a low income?

Yes, it is possible to achieve financial independence even with a low income. While it might require more time and effort, the key is to focus on managing your money effectively. Start by setting realistic financial goals and creating a budget that allows you to save and invest regularly, even if the amount is small. Look for opportunities to increase your income, such as taking up a side hustle or upgrading your skills. It's important to prioritize your expenses and cut unnecessary costs, making every dollar count towards your long-term financial goals.

How can I stay motivated while working towards financial independence?

Staying motivated while working towards financial independence is crucial for long-term success. One way to stay motivated is by visualizing the benefits of achieving financial independence, such as being debt-free, having the freedom to pursue your passions, and enjoying a secure retirement. Set milestones and celebrate small victories along the way to keep your spirits high. Surround yourself with like-minded individuals who share similar goals, as they can provide support and inspiration. Lastly, keep educating yourself about personal finance to stay informed and motivated throughout your journey.

What are some common pitfalls to avoid when working towards financial independence?

When working towards financial independence, it's important to watch out for common pitfalls that can hinder your progress. One common mistake to avoid is overspending and living beyond your means. It's crucial to stick to your budget and avoid unnecessary debt. Another pitfall is not having an emergency fund. Without an emergency fund, unexpected expenses can derail your financial progress. Investing without proper knowledge or without a diversified portfolio is another mistake to avoid. Lack of patience and trying to get rich quickly can also lead to poor financial decisions. Lastly, comparing yourself to others and trying to keep up with their lifestyle can hinder your own financial goals.