Within the depths of our minds reside awe-inspiring visions of the future. These ethereal aspirations gracefully dance before our eyes, whispering promises of prosperity and contentment. However, to transform these glimpses of greatness into tangible reality, we must embrace the power of strategic financial planning.

Just as the sea requires a rudder to navigate its vast expanse, so too do our dreams necessitate a guiding force to traverse the choppy waters of economic uncertainty. By charting a course towards your financial objectives, you can steer towards a brighter future filled with stability, personal growth, and the ability to savor life's most precious moments.

Imagine sculpting your desired reality with each subtle adjustment of your financial compass. With disciplined determination, you can harness the potential of your hard-earned wealth and direct it towards investments that breed success. The road may be arduous, but armed with a well-crafted wealth management strategy, you can navigate the labyrinth of economic endeavor and emerge triumphant on the other side.

Achieving your financial aspirations is not a mere happenstance, but a deliberate orchestration of choices and actions. It requires a comprehensive understanding of the investment landscape, a discerning eye to spot opportunities, and the persistence to weather the storms that inevitably arise. By forging a path towards your financial goals, you can leave behind the realm of illusion and step into the realm of materializing your deepest desires.

Setting Clear Financial Objectives

Establishing clear financial targets is an essential step towards realizing your aspirations for a secure future. By defining precise objectives, you can direct your efforts and resources in a focused manner, increasing the likelihood of successful outcomes. In this section, we will explore the significance of setting clear financial goals and provide guidance on how to effectively define and pursue them.

| Benefits of Setting Clear Financial Goals | Strategies for Defining Financial Objectives | Implementing and Tracking Progress |

|---|---|---|

- Enhances motivation by providing a sense of purpose and direction. - Enables prioritization of financial resources towards the most important objectives. - Facilitates decision-making and resource allocation in alignment with long-term goals. | - Reflect on your values and aspirations to identify what truly matters to you. - Break down larger goals into smaller, achievable milestones. - Utilize the SMART framework, ensuring goals are Specific, Measurable, Attainable, Relevant, and Time-bound. | - Take concrete steps towards your objectives, such as creating a budget or investing in relevant assets. - Regularly review and adjust your goals to accommodate changes in circumstances or priorities. - Track your progress, celebrate achievements, and learn from any setbacks. |

By setting clear financial goals, you empower yourself to make informed decisions and navigate your financial journey with confidence. Remember that goals may evolve over time, and it is essential to periodically reassess and adjust them based on changes in your life circumstances and aspirations. Your dedication to setting and pursuing clear financial objectives will bring you one step closer to achieving the future you envision.

Creating a Budget and Savings Plan

Building a solid financial foundation is vital for achieving our aspirations and securing a stable future. To lay the groundwork for financial success, it is essential to create a well-thought-out budget and savings plan. This section will delve into the details of developing a budget that suits your individual circumstances and establishing a systematic savings strategy.

1. Assess Your Income and Expenses:

Begin by evaluating your monthly income and expenses. Consider all sources of income, including salary, bonuses, and investments. Identify and categorize your expenses, such as housing, transportation, groceries, entertainment, and debt repayments. This comprehensive assessment will provide valuable insights into your spending habits and help you identify areas for potential savings.

2. Prioritize Financial Goals:

Before diving into the nitty-gritty of budgeting, it is crucial to outline your financial goals. Whether it is saving for a down payment on a house, paying off student loans, starting a business, or planning for retirement, determine your priorities. Setting specific and measurable goals will enable you to allocate funds accordingly and stay motivated throughout your financial journey.

3. Develop a Realistic Budget:

Once you have a clear understanding of your income, expenses, and financial goals, it is time to create a budget. A budget acts as a roadmap, guiding your spending and helping you make conscious financial decisions. Allocate funds to your essential expenses, such as housing and utilities, as well as your desired savings contributions. Be mindful of your lifestyle choices and find a balance between enjoying the present and securing the future.

4. Embrace the Power of Saving:

Now that your budget is in place, it is time to focus on the savings aspect. Determine an achievable savings goal based on your budget and financial objectives. Consider establishing an emergency fund to cushion unexpected expenses, aiming for three to six months' worth of living expenses. Explore different saving vehicles, such as a high-yield savings account, individual retirement accounts (IRAs), or investment portfolios, depending on your risk tolerance and timelines.

5. Monitor and Adjust:

Creating a budget is not a set-it-and-forget-it task. Regularly monitor your expenses and savings progress to ensure you stay on track. Assess your budget periodically and make adjustments as necessary. Life circumstances change, and so should your budget. Regularly reviewing and fine-tuning your financial plan will help you adapt to new situations and continue making progress towards achieving your financial goals.

Following these steps will empower you to take control of your finances and achieve the dreams you envision. By creating a comprehensive budget and savings plan and consistently working towards it, you will be well on your way to financial security and fulfilling your long-term aspirations.

Unlocking Your Full Income Potential

Discovering strategies to maximize your earnings is essential for achieving financial success. By harnessing the full potential of your income, you can significantly increase your chances of reaching your long-term financial goals. This section will explore various techniques and approaches to help you unlock your full earning potential.

Setting Clear Goals: One of the first steps in maximizing your earnings potential is to set clear and achievable financial goals. By identifying your objectives, whether it's saving for retirement, starting a business, or buying a home, you can align your efforts and create a roadmap to success.

Investing in Education and Skill Development: Constantly growing and improving your skillset is crucial in today's competitive job market. Investing in education, attending workshops, taking online courses, or gaining relevant certifications can expand your knowledge base and make you more valuable to employers or clients, opening up opportunities for higher-paying positions or freelance work.

Exploring Multiple Income Streams: Relying solely on a single source of income may limit your earning potential. Consider diversifying your earnings by exploring multiple income streams, such as starting a side business, investing in stocks, real estate, or other ventures. Having multiple streams of income can provide stability and potentially increase your overall earning capacity.

Networking and Building Connections: Building a strong professional network can be invaluable when it comes to unlocking your earning potential. Networking events, industry conferences, and online communities offer opportunities to connect with like-minded individuals, potential clients, or mentors who can provide insights and support to help you advance in your career or business endeavors.

Negotiating and Advocating for Fair Compensation: Don't be afraid to negotiate your salary or rates for freelance projects. Research market standards, showcase your skills and achievements, and confidently present your case for fair compensation. Advocating for yourself can significantly impact your earning potential and ensure you are appropriately valued for your contributions.

Continuous Learning and Adaptation: To maximize your earning potential, embrace a mindset of continuous learning and adaptability. Stay updated on industry trends, new technologies, and changing market demands. By learning new skills and adapting to evolving circumstances, you can stay ahead of the competition and position yourself for greater financial success.

In summary, unlocking your full earning potential involves setting clear goals, investing in education and skill development, exploring multiple income streams, networking, negotiating for fair compensation, and embracing continuous learning. By implementing these strategies, you can pave the way towards achieving your financial aspirations and realizing your dreams.

Exploring Different Investment Opportunities

Delving into various investment opportunities is an essential step towards realizing your financial aspirations. By exploring different types of investments, you can uncover potential avenues for growth and prosperity. This section aims to provide a comprehensive overview of the diverse investment options available, allowing you to make informed decisions that align with your goals and risk tolerance.

1. Stocks:

- Common Stocks

- Preferred Stocks

- Blue-Chip Stocks

- Growth Stocks

- Value Stocks

- Dividend Stocks

2. Bonds:

- Government Bonds

- Corporate Bonds

- Municipal Bonds

- Treasury Bonds

- Convertible Bonds

- Junk Bonds

3. Mutual Funds:

- Equity Funds

- Bond Funds

- Index Funds

- Money Market Funds

- Exchange-Traded Funds (ETFs)

4. Real Estate:

- Residential Properties

- Commercial Properties

- Real Estate Investment Trusts (REITs)

- Real Estate Syndication

- Real Estate Crowdfunding

5. Commodities:

- Gold

- Silver

- Crude Oil

- Natural Gas

- Agricultural Commodities

6. Cryptocurrencies:

- Bitcoin

- Ethereum

- Ripple

- Litecoin

- Bitcoin Cash

- Cardano

Each type of investment carries its own unique characteristics, risk profiles, and potential returns. By diversifying your investment portfolio across these various options, you can mitigate risk and increase the likelihood of achieving your financial objectives. Remember to conduct thorough research, seek professional advice, and assess your individual circumstances before making any investment decisions.

Utilizing Technology for Efficient Financial Management

In today's rapidly evolving digital age, individuals have unprecedented access to a vast array of technology tools that can revolutionize their approach to financial management. By leveraging the power of technology, people can streamline their financial processes, enhance their financial decision-making capabilities, and ultimately achieve their desired financial outcomes.

One of the key advantages of using technology for financial management is the ability to automate and simplify routine tasks. Financial apps, online banking platforms, and budgeting tools can help individuals effortlessly track their expenses, categorize their income, and create personalized budgets. By automating these processes, individuals can save time, eliminate errors, and gain a clearer understanding of their financial health.

Moreover, technology provides individuals with access to real-time financial data and analysis. From stock market updates to personalized investment recommendations, financial technology allows people to stay informed and make data-driven decisions. Advanced algorithms and machine learning algorithms empower individuals to optimize their investment strategies, identify potential risks, and seize lucrative opportunities.

Furthermore, technology enables individuals to securely access their financial information anytime, anywhere. With the rise of mobile banking apps and digital wallets, people can conveniently manage their accounts, make transactions, and track their financial progress on their smartphones or other portable devices. This enhanced accessibility ensures individuals can stay on top of their financial responsibilities and make informed financial decisions on the go.

In conclusion, embracing technology in financial management can be a game-changer for individuals looking to achieve their financial goals. By automating tasks, leveraging real-time data, and embracing enhanced accessibility, people can take control of their finances, make informed decisions, and work towards their desired financial future.

Protect and Secure Your Assets while Minimizing Risks

With the aim of safeguarding your valuable possessions and reducing potential hazards, it is crucial to implement strategies that prioritize asset protection. This section will provide you with essential insights and practical tips on how to shield and secure your assets effectively.

- Invest in Insurance: One of the most common and reliable methods of asset protection is obtaining various insurance policies. Insurance coverage such as property, health, life, and liability insurance can minimize financial risks in case of unexpected events or accidents.

- Diversify Your Portfolio: Spreading your investments across different asset classes, such as stocks, bonds, real estate, or commodities, can help mitigate potential risks. Diversification allows you to minimize the impact of any individual investment's poor performance on your overall financial position.

- Create a Trust: Establishing a trust can be an effective tool for protecting your assets and ensuring their management and distribution according to your wishes. Trusts provide an added layer of security by separating your assets from your personal liability.

- Implement Asset Protection Structures: Utilizing legal vehicles like limited liability companies (LLCs) or family limited partnerships (FLPs) can help shield your assets from potential lawsuits or creditors. These structures can provide added protection by separating your personal assets from your business or investment holdings.

- Maintain Adequate Emergency Funds: Having a reliable emergency fund can act as a safety net in case of unforeseen circumstances. Maintaining an accessible cash reserve equivalent to several months' worth of expenses can protect you from the need to liquidate investments at an unfavorable time or incurring debt during emergencies.

By diligently safeguarding your assets and minimizing risks, you can strive towards achieving a secure financial future and effectively protect the fruits of your hard work.

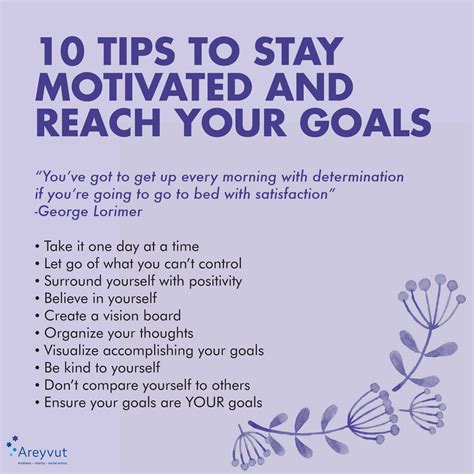

Staying Motivated and Persistent in Reaching Your Aspirations

In this section, we will explore the essential strategies to stay motivated and persistent on your path towards attaining your desired financial accomplishments. Maintaining a sense of determination and focus is crucial to overcoming obstacles and achieving long-term success. By employing effective techniques and adopting a positive mindset, you can navigate through challenges and stay motivated throughout your journey.

1. Cultivate a Clear Vision: In order to stay motivated, it is essential to have a clear and vivid vision of what you want to achieve. Visualize your financial aspirations, create mental images of the lifestyle you desire, and set specific goals that correspond to those visions. When you have a clear sense of where you are heading, it becomes easier to stay motivated and take consistent action towards your objectives.

2. Break It Down: Big goals can sometimes feel overwhelming. To prevent this, break down your financial aspirations into manageable and realistic tasks. Setting smaller milestones and focusing on incremental progress can help you maintain motivation as you witness tangible results along the way. Celebrating these smaller achievements will keep you motivated to continue pursuing your larger goals.

3. Seek Inspiration: Surround yourself with sources of inspiration that will remind you of the importance and benefits of achieving your financial goals. Read success stories of individuals who have overcome similar challenges and achieved financial success. Join online communities or forums where like-minded individuals share their experiences and offer support. Connecting with people who have similar goals can provide encouragement, advice, and motivation throughout your journey.

4. Embrace Positivity: Positive thinking plays a significant role in staying motivated and persistent. Cultivate a positive mindset by focusing on your strengths and abilities, adopting an optimistic outlook, and reframing challenges as opportunities for growth. Surrounding yourself with positive influences, such as motivational books, podcasts, or affirmations, can further enhance your mindset and reinforce your determination.

5. Stay Accountable: Hold yourself accountable for your actions and progress towards your financial goals. Set regular check-ins and evaluate your progress objectively. Track your achievements, celebrate milestones, and address any areas that require improvement. Having a sense of accountability will create a sense of ownership and keep you motivated to consistently work towards your aspirations.

- Cultivate a clear vision

- Break it down

- Seek inspiration

- Embrace positivity

- Stay accountable

By implementing these strategies, you can maintain your motivation, overcome obstacles, and persistently work towards achieving your financial goals. Remember, staying motivated is a continuous process, so embrace the journey and stay focused on your vision of success.

FAQ

How can I achieve my financial goals?

There are several ways to achieve your financial goals. One important step is to clearly define your goals and create a plan with specific actions and timelines. It's also crucial to save and invest wisely, cut unnecessary expenses, and stay consistent with your financial strategies. Seeking professional advice from a financial advisor can also be helpful in developing a strategy tailored to your situation.

What are the benefits of making regular deposits?

Making regular deposits has several benefits. Firstly, it helps you develop a disciplined savings habit and accumulate wealth over time. It also allows your money to grow through compound interest, which can significantly boost your savings. Regular deposits also create a sense of financial security and provide a foundation for achieving your long-term financial goals. Additionally, consistent deposits can potentially help you qualify for better loan terms or credit opportunities.

How long does it usually take to achieve financial goals through saving deposits?

The time required to achieve financial goals through saving deposits varies depending on a multitude of factors. It primarily depends on the size of your goal, your current financial situation, the amount you can save each month, and the interest rate on your savings account. Generally, the larger the goal, the longer it will take to achieve. However, with consistent saving and smart financial planning, it is possible to reach your goals within a few years or even sooner.